What Drives TiO2 Demand?

The TiO2 industry is experiencing a period a significant evolution during 2019, seeing some unprecedented developments. Evolving developments include:

- Commercial structure,

- Industry leadership developments,

- Feedstock developments,

- Product segmentation.

TiPMC will review these developments in detail in future articles, but the logical starting point is the drivers for underlying demand. TiPMC has teamed with former DuPont Economist Robert Fry of Robert Fry Economics LLC to review the subject in detail.

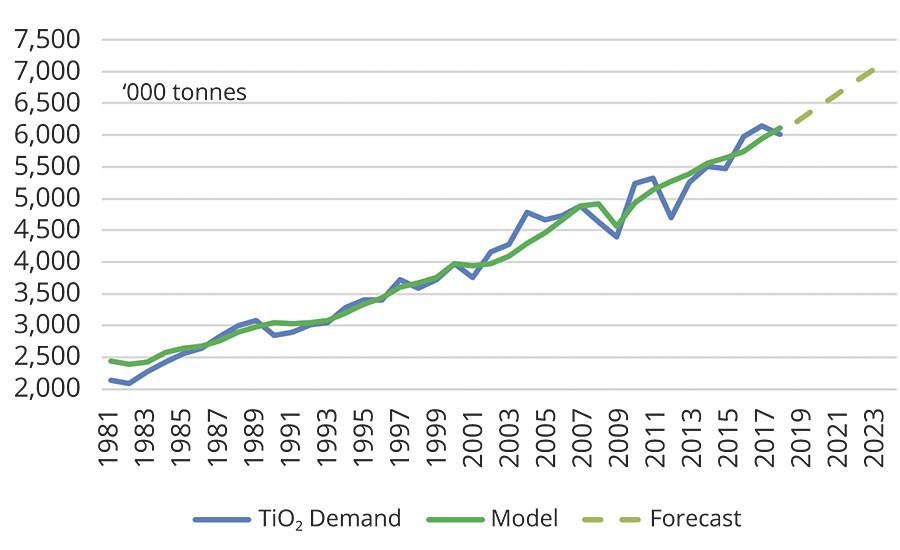

Fry noted the TiO2 demand is more closely correlated to industrial production than to GDP, and that the correlation between TiO2 demand and GDP is likely to decline as service sectors grow as a share of global GDP.

The linear relationship between TiO2 and industrial production demonstrates a very close correlation, but deviations from the fitted relationship have been larger in recent decades than in prior ones.

Why is this occurring? TiPMC offers these thoughts:

- The rise of China and the USD housing boom/bust contributed to variation in the 2000s.

- Increased Chinese production in the form of numerous small-scale producers and plants adds to variability in stocking and destocking.

- The global financial crisis, the reduced output followed by overstocking driven by fear, and rapid Chinese capacity increase, where the main contributors to the super-cycle earlier this decade.

What does this mean for the future? Variability is the driver for the price and margin stabilization initiatives announced by the larger multi-national producers. More mid-size players are moving their portfolios in the direction of increased functional, higher specialty products, decreasing their reliance on commodity markets. The success or failure of these strategies is in large part to be determined by their own willingness to manage the period when the strategy is pressured, in order to reap the benefits of the longer term.

What do we expect in the short term? Fry states, “This spring, I thought that growth in Chinese manufacturing had bottomed and that a rebound in housing would support U.S. economic growth in the second half of 2019. Given the increase in U.S. tariffs on $200 billion of Chinese goods from 10% to 25% and the threat of tariffs on another $300 billion of Chinese goods, I’ve lowered my forecast for the rest of 2019 and pushed my forecast for stronger growth into 2020.”

TiPMC believes TiO2 will maintain its position as a leading indicator of economic trends. Based on Fry’s comments, TiPMC expects the relative strength of demand during the September and October “golden season” in China to serve as a check on the industry demand for 2020. The uncertainty around 2020 demand remains higher as the noted macro uncertainties easily filter down to TiO2 demand. Using history as a guide, the longer the period demand remains below the referenced equation, the stronger the return to the trendline occurs.

What to read next:

Is the TiO2 Pricing Tide Turning?

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!