Is the TiO2 Pricing Tide Turning?

Titanium dioxide (TiO2), the key ingredient that provides opacity in coatings, saw reduced global demand in 2018 by 3-4% vs. 2017, closely following the weaker growth of economies in China, the rest of Asia, Europe and the Middle East.

Chinese producers were primarily responsible for over-production in the export market, while pricing was high and -Chinese demand was low. Led by Chemours, multi-national producers (MNPs) reducing production and inventory are accelerating destocking activities.

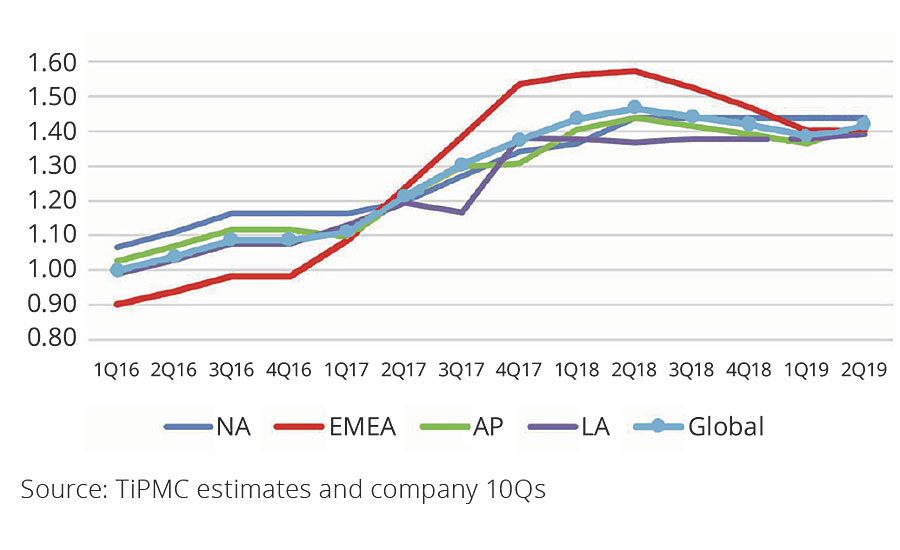

The tide for TiO2 pricing is showing signs of changing as stronger demand and limited capacity position supply-and-demand dynamics in favor of producers. Roots of the most recent pricing downturn are seen via export data from China (Figure 1).

Higher prices in Europe, during a period of weakness in domestic markets, drove Chinese product into the hands of European buyers eager to stem the tide of 10 consecutive price increases starting in 1Q16. Stocks grew, and as demand in Europe, the Middle East and Asia curtailed, the end of a traditionally strong 2Q came to an end. Fears of an extended downward trend were mitigated.

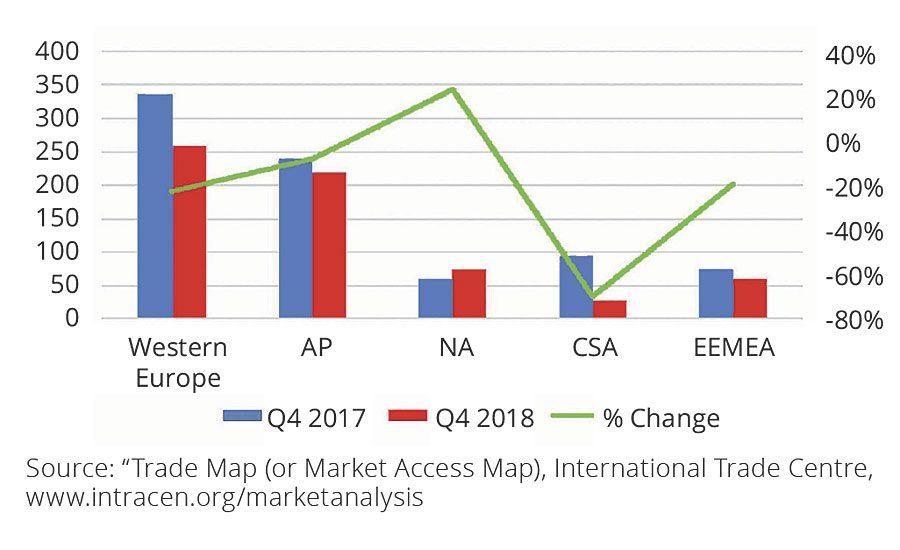

Global exports during the 4Q18 were very reflective of regions where destocking was necessary and where demand was stronger.

European imports were impacted most, as this was the region at the epicenter of high stock and low demand. High-growth Asia saw reduced imports, despite long-term expectations for 5-6% growth. Central and South America saw a significant import reduction as political unrest and severe economic downturn gripped importing countries. Conversely, North America saw strong demand and stable pricing, attracting more imports (Figure 2).

Pricing is beginning to reflect destocking coming to a close. Based on recent reports and trade data, TiPMC foresees prices stabilized in all regions during the traditionally strong demand period of 2Q, with price increases gaining traction toward the end of the quarter in specific regions (Figure 3).

Although global demand slowed in 2H18 as stocks increased, indications are Chinese domestic demand strengthened as production remained strong, yet net exports decreased.

When trade tensions ease and the Chinese economic stimulus begins to make an impact on its economy, return of demand growth in Asia will contribute to restoring TiO2 demand growth.

Most estimates for yearly architectural coatings growth in Asia are in the 5.5-6% range for the next five years. Because Asia is the largest TiO2-consuming coatings segment, this is very good news for the TiO2 industry. The challenge appears to be getting back on track in the short term.

For more insights into the TiO2 and mineral sands markets, or to subscribe to TiPMC industry reports and forecasts, call 610/274-1603 or visit www.tipmcconsulting.com.

What to Read Next:

Asian Demand Triggers Mixed Pricing Signals Worldwide

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!