China’s Anti-Corrosion Coatings Market

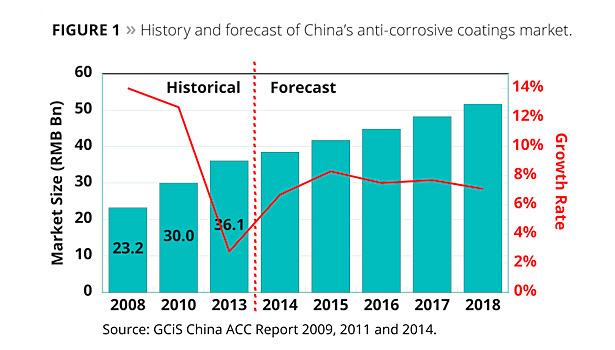

Over the last few years, the growth of China’s anti-corrosion coatings market has dropped precipitously. According to a recent report from GCiS China Strategic research, overall market growth was just 2.8% in 2013 to a RMB ¥36 billion or roughly USD $5.8 billion market – far worse than the 13% growth experienced as recently as 2011 (Figure 1). However, both domestic and multinational companies expect conditions to improve significantly over the next few years, pointing to developments below the surface of this headline growth figure. Industry insiders report that the recent slow growth is largely a result of difficulties in the shipbuilding and container sector, while other major end-user industry segments such as construction and petrochemicals are seeing much stronger performance. Improving technology and mounting domestic demand for high-quality products, alongside a likely future revival of the shipbuilding sector are likely to lead to much healthier growth rates in approximately three to five years.

Shrinking Shipbuilding Orders

For many years, the most important market for anti-corrosion coatings in China has undeniably been the shipping industry. Ship coatings – including both newly built ships and recoating – accounted for over RMB ¥7.5 billion in revenues in 2013, with a further RMB ¥4.2 billion coming from coatings for shipping containers. However, the Chinese – and indeed global – shipbuilding sector has recently seen a steep decline, with the total deadweight tonnage of newly completed ships down almost 25% in 2013 according to government figures. This steep fall follows a similar decline in 2012 shipbuilding output.

Industry observers blame the situation on an overcapacity in the global shipping fleet, a condition that traces its origin back to the financial crisis of the last decade. The length of time it takes to construct a large oceangoing vessel means that there is a lag between changing industrial output and the production of new ships. Although global production and international trades are now once more increasing, this increase is not sufficiently fast enough to fill up the bulk carriers and container ships that already exist. Furthermore, in an attempt to crack down on overcapacity-plagued heavy industries such as shipbuilding, a change in Chinese lending policies towards shipyards has also had an effect; loans are now more difficult to obtain, giving pressure to shipyards on operating cash flow and further investment.

Although the need for maintenance and recoating has gone some way to insulate anti-corrosion coatings suppliers from the full effect of the declining shipbuilding market, the fall in new ship construction has nevertheless had a strong impact on domestic and foreign firms alike. One interview with a foreign-owned anti-corrosion coatings supplier stated that “weak demand for new ships is our main challenge in the current Chinese market,” providing a typical example of suppliers’ opinions regarding this field.

Strong Demand from Other Sectors

Fortunately for coatings suppliers, shipbuilding is not the only industry that is affected by corrosion (Figure 2). Interviews with suppliers reveal that other end-use sectors are experiencing rapid growth, which has more than made up for the fall in marine coating sales.

One of these sectors is the oil, gas and petrochemicals industry. Along with massive import and domestic transmission pipeline construction, new storage tanks have been constructed, as China has placed a strong emphasis on expanding the country’s strategic and commercial oil reserves. Meanwhile, new refineries have also been constructed, which also raises demand for anti-corrosion coatings. Akin to the shipbuilding industry, this sector requires high-end coatings, which naturally carry high prices, and the enormous oil companies that dominate China’s petroleum industry have proved themselves willing to pay these prices. Chinese coating companies have seen the most benefit from the growth of this market, as suppliers report that state-owned oil companies prefer to purchase from domestic suppliers to a greater extent than shipyards or vessel owners.

Another field in which anti-corrosion coatings are seeing strong growth is the construction sector. Coatings in this industry are growing at a faster rate than the overall downstream growth rate would imply, due to the increasing prevalence of steel structure construction. As these structures are not continuously exposed to salty seawater or corrosive chemicals, the required standard for these coatings is significantly lower than that of the marine or petroleum sectors. However, the large scale of this industry means that the overall market size is rapidly approaching that of marine coatings. In fact, if containers are excluded, revenues from this sector are likely to surpass those from the shipping industry in 2014, after being only slightly lower in 2013.

The two sectors discussed above are responsible for the largest overall growth in anti-corrosion coatings revenue. However, they both fall well behind wind turbines when the growth rate is considered in percentage terms. China has recently seen a rapid drive for increased renewable energy capacity, with wind power being one of the leading contributors. Total grid-connected wind power capacity has increased by a staggering 385% in the last four years, with yearly growth averaging 48% between 2009 and 2013. There has been similar if not higher growth in the market for anti-corrosion coatings for wind turbine blades, with the power sector as a whole now making up almost 8% of total market revenues.

Product and Technology Trends

Epoxy coatings currently have the strongest opportunities for both multinational and Chinese suppliers. These coatings represent the largest share of the market by total revenues and an even larger share by sales volume. Epoxy coatings have good weather and corrosion resistance, are cost-effective, and are the most widely used coating type across a wide variety of end-user industries. They also have a range of uses, being used in primers and topcoats as well as their more common use in midcoats, and can be made into more environmentally friendly water-based coatings.

Besides epoxy, polyurethane coatings are expected to see increasing usage in the future, especially in the higher-end market, both as a heavy-duty coating and for more decorative purposes. This is already the second largest segment of the market, and foreign suppliers have advantages in this area due to their greater technological strength – although Chinese domestic suppliers are investing in research and development and closing the gap, the general consensus among industry insiders appears to be that they will not catch up to their foreign counterparts in the short term.

Stricter environmental regulations, and higher environment and safety consciousness among customers is also leading to a larger market for more environmentally friendly coatings, particularly water-based coatings. Chlorinated rubber coatings are seeing a strong negative influence from these regulations and an overall decline in sales volumes, as these coatings are seen as environmentally harmful. Epoxy coatings are seen as amenable to this technology, and a number of suppliers are investing in water-based epoxy coatings. Although this trend is still at a relatively early stage in the Chinese market, especially compared to more developed countries, it is expected to accelerate over the medium to longer term; this will bring advantages to companies with strong technology as this will be needed to offset the performance disadvantages of these water-based coatings.

Shipbuilding Recovery Will Lead the Way

The Chinese anti-corrosion coating market is likely to continue experiencing slow growth over the next few years as the shipbuilding industry continues to underperform. However, there are already strong signs of a revival in this key downstream industry, with new ship orders up significantly since 2013. According to China’s Association of the National Shipbuilding Industry, total orders on hand increased to 131 million deadweight tonnage by the end of December, a 22.5% increase compared with a year ago. This growth has continued through the first half of 2014, and between January and June of this year orders on hand have already increased 16.1% over 2013 figures. It will take some years before these ships are ready to be coated, but sales to this industry are likely to see resumed growth around 2016-2018. By this time, the construction industry will make up a significantly larger share of the market than shipbuilding, by revenue as well as sales volume. It is unlikely that shipbuilding will ever overtake this sector and reclaim its current position as the largest end user industry for anti-corrosion coatings in China.

For more information, email research@gcis.com.cn or visit www.GCiS.com.cn.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!