Epoxy Resins Market: Will U.S. and European Supply Remain a Surplus?

Margins touching near-zero figures, murky demand outlook and overcapacity are the problems that have plagued the epoxy resins market in 2013. Epoxy resins find major application in the electronics, automobile and construction industries. With demand not rising to the expected levels across the globe, there is a structural overcapacity in the market. The demand and supply gap started increasing in 2011 and reached the levels of 0.9 million MT in 2013. Free trade agreements (FTAs) and currency arbitrages worsened the situation as Asian players tried to capture the shares in western markets by selling at highly competitive prices.

The major reasons behind this huge demand supply gap are:

Huge Capacity Additions in Asia – Huge capacity additions were witnessed in Asia, especially in South Korea. Total capacity in China and South Korea has increased from 1.5 million MT in 2011 to nearly 2 million MT in 2013. This can be attributed to an FTA that came into existence in July 2011. The FTA led to flooding of LER in the European Market by South Korean players, as the prices offered were highly competitive. The U.S. market is also facing high influx of low-priced LER from Chinese suppliers.

Feeble Demand – Demand growth for LER nosedived in 2013 due to low demand from China, particularly from the electronics segment, as it is the biggest end-use sector of epoxy resins in China. Demand from the European market continued to remain weak owing to poor macroeconomic conditions. However, LER demand in the United States picked up, owing to the recovery of automobile and construction industry since August 2013.

Factors adding to the woes of manufacturers other than structural overcapacity and weak demand are:

Middle East Conflict – Bisphenol-A (BPA) and Epichlorohydrin (ECH) are the major feedstocks to make epoxy resins. Prices of ECH and BPA are highly co-related with the prices of propylene and benzene. Benzene and propylene are highly affected by the crude oil market, which remained quite volatile in terms of pricing due to the U.S. and Middle East conflict.

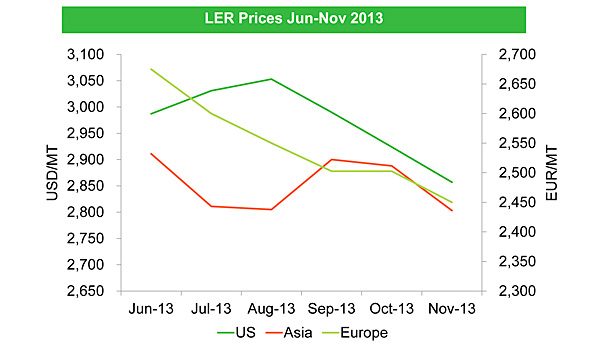

Currency Fluctuations – The Dollar and Euro have appreciated considerably compared to Asian currencies since June 2013. This has opened up a potential arbitrage window for Asian manufacturers, wherein they are earning the margins of 4-5% just because of depreciation of their currency. So, Asian manufacturers are pushing the margins to the lowest possible limits in order to gain the share in western markets.

If the market conditions have been hostile for suppliers, they have been confusing for buyers too, even though prices of epoxy resins have witnessed a continuous dip since June 2013 (except for a few spikes).

Prices May Have Bottomed Out Already

Most of the manufacturers in the European and U.S. markets believe that prices of epoxy resins have reached the bottom-most level and the only way price can move now is upwards. This can be majorly attributed to a continuous dip in epoxy resin prices despite increase in prices of raw materials, thus squeezing out the margins nearly to zero.

What the Future Holds for Manufacturers?

Recovering European Economies: European economies are expected to recover amidst improvement in the manufacturing sector. All countries except Greece and France experienced improvement in their manufacturing PMI (Purchasing Managers’ Index), and overall PMI for the EU 27 stood at 51.3, almost at the highest level in 26 months. Improvement in manufacturing is likely to lead to increase in demand for epoxy resins, thus giving positive outlook to epoxy resins manufacturers. As the demand is expected to increase, the supply demand gap is expected to decline.

Dow Divestment Plans: As Dow is planning to divest its epoxy resins-related assets through sales or joint venture, there is a possibility that the supply demand gap may further reduce and give manufacturers a chance to increase the prices.

Expected Strengthening of Asian Currencies: Asian players may try to push the prices further down. However the arbitrage window is likely reduced on account of anticipated appreciation of Asia currencies, due to expected improvement in domestic as well as export demand for goods and services. Reduced gains on arbitrage may force Asian suppliers to raise the prices for epoxy resins.

Shale Gas Impact: As the benzene and propylene manufacturers are shifting from crude oil to shale gas as a feedstock, it is becoming increasingly difficult to forecast the price movements. If abundant supply of shale gas and low cost of production push the prices down, low production rates of the process curtails the supply (of benzene and propylene) to increase the prices. With increasing uncertainty on the prices of benzene and propylene, it has become difficult to predict the movement prices of epoxy resins.

Buyer’s Position: Buyers are currently finding themselves in quite an awkward position. Currently, it is more profitable for them to buy in the spot market. However, buyers are not sure whether spot prices will remain lower than contract prices next year. Buyers need to make a call on their strategy to procure epoxy resins. With market conditions expected to favor manufacturers, buyers need to take a look at the proportion of material they are buying from contract and spot markets. Increasing the material brought from contract market may increase the cost in short term. However, engaging in long-term contracts is expected to be beneficial in the long term as the murky demand outlook is expected to fade and the power of Asian suppliers is likely to reduce. This may push the prices upwards and lead to higher prices of epoxy resins in the spot market during 2014.

Conclusion

Summarizing, the epoxy resins market has been in doldrums with buyers and suppliers both facing difficult times. However, with anticipated improvement in demand for epoxy resins in western markets and reduction on arbitrage window for Asian suppliers, manufacturers of epoxy resins in the United States and Europe can expect a sigh of relief. Western epoxy resins manufacturers may seek to increase prices to improve their margins, which have been squeezed to zero in 2013.

On a concluding note, the market outlook of epoxy resins is fairly bright for manufacturers. With demand improving and the supply demand gap expected to reduce, supplier power will increase and buyers should remain prepared with strategies to reduce their costs.

About the Author

Karunesh Pushkarna is a Senior Research Analyst with Beroe Inc., a global provider of customized procurement services specializing in sourcing, supply chain visibility, financial risk analysis and environmental impact to Fortune 500 organizations.

Karunesh Pushkarna specializes in tracking epoxy resins, ethyl acetate and acetic anhydride. He has worked on multiple projects for many Fortune 500 clients involving categories such as Process Chemicals, Mining Chemicals, Water Treatment Chemicals, Industrial Solvents, and Intermediates.

Karunesh Pushkarna earned his degree in Industrial Engineering from the Thapar University, Patiala.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!