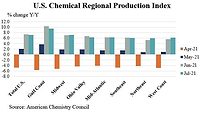

U.S. Chemical Production Dips in August

WASHINGTON, DC — According to the American Chemistry Council (ACC), the U.S. Chemical Production Regional Index (U.S. CPRI) slipped 0.3 percent in August, following an upwardly revised 0.2 percent gain in July. Year-over-year production remains positive.

On a three-month moving average (3MMA), output of the nation’s overall manufacturing sector edged higher by 0.2 percent in August, following a 0.1 percent gain in July. Within the manufacturing sector, output in several key chemistry end-use markets grew, including semiconductors, structural panels, furniture, appliances, rubber products, apparel, machinery, motor vehicles, construction supplies and metal products. Manufacturing demand is a significant driver of demand for chemistry products. Recent months have seen weaker growth as a result of lower exports and the impact of the sequester. Higher construction activity and vehicle sales, however, in addition to recovery in Europe and faster growth in China, will increase demand for manufactured goods, including chemicals.

Also measured on a 3MMA basis, overall chemical production was again mixed. Gains in the output of pesticides, chlor-alkali, coatings, other specialties, industrial gases, and synthetic rubber were offset by lower production of organic chemicals, pharmaceuticals, acids, consumer products, plastic resins, adhesives, fibers, and fertilizers.

Compared to August 2012, total chemical production in all regions accelerated to a 1.2 percent year-over-year gain, following a 1.4 percent gain in July. All regions were ahead compared to a year ago.

The chemistry industry is one of the largest industries in the United States, a $770 billion enterprise. The manufacturing sector is the largest consumer of chemical products, and 96 percent of manufactured goods are touched by chemistry.

Moore Economics developed the U.S. CPRI to track chemical production activity in seven regions of the United States. It is comparable to the U.S. industrial production index for chemicals published by the Federal Reserve.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!