A Profile of the Russian Paint Industry

The industrial coatings sector has experienced high growth during the period of recovery from the 2009 financial crisis, especially in the automotive OEM and powder coatings areas. The sector is forecast to grow steadily at 6% p.a. in line with the growing end-user industries, and again stronger consumer spending power will underpin this.

Growing end-user awareness of the environmental impact of coatings is one of the key drivers in the Russian decorative paint market, even in the absence of Russian legislation in this regard. There is rising concern in Russia about health, safety and environmental matters, which is contributing to the growing popularity of firstly low-VOC and then water-based paints. The low-quality/economy paint segment holds the largest share of the decorative market, with a fast-growing super-economy segment, which includes such important applications as paint for refurbishing Russian summer houses (“dachas”). In the long term, there will be a trend towards more medium quality paint usage in the market, as more and more organizations will be able to move their product portfolio from the economy to the medium segment. The Russian decorative paint market divides almost evenly between DIY and professional applications, with the latter showing higher growth rates.

One of the key mid-term marketing opportunities for the Russian coatings market will be the hosting of the Winter Olympic Games by the Russian city of Sochi in 2014. The new construction and infrastructure projects required for this prestigious sporting event will create an additional demand for architectural, protective and industrial coatings.

Industrial coatings are poised for growth over the forecast period, with the highest growth expected in the segments of marine paints and coatings for bridges and tunnels. For the next five years, good growth rates are predicted for various downstream industries in Russia, including furniture production, consumer electronics, automotive, road building, ship building, yachting and others.

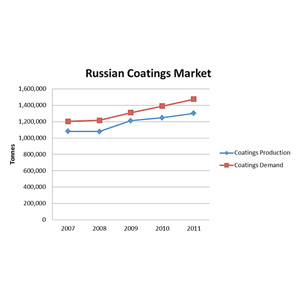

IRL forecasts that the total Russian paint market should increase from a total of 1,475,000 tonnes in 2011 to 1,881,000 tonnes in 2016, and it is the OEM-based business-to-consumer segments that will represent growth opportunities as consumer spending continues to rise.

The Russian paint industry faces a few challenges in terms of its balance of trade. Although the continued penetration of Western paint makers into the Russian market is good for both demand and technology, local producers are unable to compete effectively in international markets. When it comes to exporting paints to European markets, Russian manufacturers have to take into account the growing competition from European paint suppliers, and also to consider their compliance with the encroaching REACH legislation. As a result, the main destinations which Russian paint makers target continue to be neighboring CIS countries.

The Russian paint industry faces a few challenges in terms of its balance of trade. Although the continued penetration of Western paint makers into the Russian market is good for both demand and technology, local producers are unable to compete effectively in international markets. When it comes to exporting paints to European markets, Russian manufacturers have to take into account the growing competition from European paint suppliers, and also to consider their compliance with the encroaching REACH legislation. As a result, the main destinations which Russian paint makers target continue to be neighboring CIS countries.

The local industry needs to utilize its strengths of established long-term partnerships between local producers and customers, and build its competitiveness in terms of price levels and marketing strategies.

IRL’s latest report on the Russian paint and coatings sector offers a comprehensive overview of the industry and market, including recent paint production statistics by company, analysis of international trade and an insight into the nine mainstream coatings segments.

With an extensively revised directory of Russian paint companies included, the report provides our clients with a good initial starting point for a fresh look at Russian market.

A Profile of the Russian Paint Industry, 4th Edition, costs €3,250 for a single copy. Sections of the report will be available shortly to buy online at IRL's website, www.informationresearch.co.uk.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!