PU Chemicals and Products in Europe, the Middle East and Africa, 2010

IAL Consultants announced the recent publication of the eighth edition of its report on the markets for Polyurethane Chemicals and Products in Europe, the Middle East and Africa.

It should be noted that

Volume 5, the Executive Summary, is only available to purchasers of the

complete study.

It should be noted that

Volume 5, the Executive Summary, is only available to purchasers of the

complete study.

Having enjoyed a period of good growth, the polyurethanes industry was adversely affected by the global financial crisis that hit towards the end of 2008. Total production of polyurethane products is reported to have been 5,066,440 tonnes within the EMEA region during 2009, compared with almost 5.4 million tonnes in 2007. By 2014 this figure is forecast to be 5,867,777 tonnes, equivalent to mean growth of 2.9% pa over the next five years, despite concerns over GDP growth.

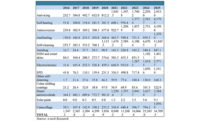

Of the three regions considered, the polyurethane industry remains the largest in Western Europe, but growth rates are strongest in Eastern Europe and the Middle East (Table 1).

Total production of polyurethane by major product type is shown in Figure 1.

Rigid foams are likely to be one of the most dynamic areas of growth in future polyurethane production, growing at a mean of nearly 4% pa across the entire EMEA region. Energy efficiency legislation within the EU is driving demand for rigid panels in Europe and has already stimulated strong demand in Germany and parts of Central Europe. PU/PIR flexible faced panels (and to some extent spray foams) are the main areas benefiting from this. Refrigeration applications in general have experienced a crippling time in Western Europe, especially as the replacement of energy-efficient domestic models has fallen, but in Eastern Europe, the expansion of the retail sector offsets this. The renovation of district heating pipework, as well as cooling – predominantly in Eastern Europe and the Middle East– looks likely to be a major driver for rigid foam pipe insulation in the coming years.

Adhesive applications continue to be driven by the regulatory need for low-VOC content; isocyanates are potentially the major area of concern running through most areas of PU adhesive use. Although the transport and construction sectors in Western Europe have been impacted by the economic downturn, flexible packaging adhesives have been more resistant to its effects. Manufacturers continue to adapt their packaging in order to reduce waste and weight, so light, flexible and single-use packaging is continuing to grow in demand. Isocyanate migration in areas such as food packaging means that the PU segment is experiencing rising competition from acrylic alternatives.

Eastern Europe represents a key opportunity for suppliers of PU adhesives, mainly through exports. Local production of PU adhesives is weak, but in general Eastern European markets are dominated by a wide range of cheaper adhesives, making conversion to more expensive adhesive use an uphill battle.

Footwear, which is an important segment for PU elastomers, is experiencing a struggle on many fronts as far as the industry is concerned. In addition to the relocation of large parts of the shoemaking industries to Asia, the Western European segment finds that fashion trends are currently going away from polyurethane use, but future short-term trends can always reverse this. TPUs are finding greater use within the mainstream footwear segment as a result of the development of softer grades, advancing their applications beyond sporting footwear. Increasingly, many of the top companies are developing application-specific TPUs for use in different industries.

This five-volume report is comprised of more than 1,400 pages and more than 900 tables of data. The data includes raw material consumption by product type, by region and by major end-use industry, supported with industry data on production volumes by major manufacturer. Profiles of leading flexible foamers and raw materials manufacturers are also included.

The report is available for the following prices:

Volume 1 - Raw Materials €4,500

Volume 2 - Foam Products €5,500

Volume 3 - Non-Foam Products €3,500

Volume 4 - Major End-Use Markets €3,500

Volume 5 - Executive Summary

THE COMPLETE REPORT €13,500

For more details, contact Mrs. Cathy Galbraith, IAL Consultants, CP House, 97-107 Uxbridge Road, Ealing, London W5 5TL; Telephone +44 (0) 20 88 32 77 80; E-mail cathygalbraith@brg.co.uk; or visit www.ialconsultants.com.

Having enjoyed a period of good growth, the polyurethanes industry was adversely affected by the global financial crisis that hit towards the end of 2008. Total production of polyurethane products is reported to have been 5,066,440 tonnes within the EMEA region during 2009, compared with almost 5.4 million tonnes in 2007. By 2014 this figure is forecast to be 5,867,777 tonnes, equivalent to mean growth of 2.9% pa over the next five years, despite concerns over GDP growth.

Of the three regions considered, the polyurethane industry remains the largest in Western Europe, but growth rates are strongest in Eastern Europe and the Middle East (Table 1).

Total production of polyurethane by major product type is shown in Figure 1.

Raw Materials

Supplies of TDI in the global market are likely to become more balanced in the remainder of 2010 following a period of slack demand as a result of the global economic crisis and then demand exceeding supply in Europe. Recovery is expected in the demand for TDI, and it may reach 2007/8 levels by 2014. Similarly, demand for MDI is expected to recover only slowly in line with construction sector expenditure, largely from 2011 onwards. Polyester polyols have experienced declining demand too, but still there are selected expansions to be expected. Biopolyols, or natural oil polyols (NOPs) are only a small eco-friendly aspect of the market but are typical of the industry’s consideration of green chemicals, which on the whole, are being tested for consumer attitudes and acceptance.Flexible and Rigid Foams

The flexible foam market is quite dependent upon consumer spending on big-ticket items such as furniture and bedding. As a result of the economic downturn, Western European production and demand has been lower but in some countries such as Poland production has held up quite well. Future demand growth, especially in the polyether slabstock sector, is generally dependent upon economic recovery. In the bedding sector, foam mattresses are continuing to take market share from their sprung rivals, and this trend is expected to continue, especially in Southern Europe, where there is still considerable room in the market. Demand for molded foams has also fallen in parallel with the performance of the European automotive sector. Prospects for countries in the Middle East and Africa are attractive for the future, especially with regard to molded foams for furniture applications.Rigid foams are likely to be one of the most dynamic areas of growth in future polyurethane production, growing at a mean of nearly 4% pa across the entire EMEA region. Energy efficiency legislation within the EU is driving demand for rigid panels in Europe and has already stimulated strong demand in Germany and parts of Central Europe. PU/PIR flexible faced panels (and to some extent spray foams) are the main areas benefiting from this. Refrigeration applications in general have experienced a crippling time in Western Europe, especially as the replacement of energy-efficient domestic models has fallen, but in Eastern Europe, the expansion of the retail sector offsets this. The renovation of district heating pipework, as well as cooling – predominantly in Eastern Europe and the Middle East– looks likely to be a major driver for rigid foam pipe insulation in the coming years.

CASE Applications

In the polyurethane coatings segment, expected growth in their production in Western Europe is placed at 1.6% pa in the coming years, while that expected in the Middle Eastern and African area is more than twice this, where commercial vehicle production and architectural applications are likely to lead segmental growth. Polyurethane dispersions (PUDs) are gaining ground as a result of their strong performance and regulatory credentials, and this is especially the case in Eastern European and Middle Eastern areas, where leather, textile and flooring applications are already benefiting from their superior attributes. The subsegment of UV-curable PUDs has been demonstrating strong growth in Northern Europe and Germany, where growth rates are in the double-digit percentage class.Adhesive applications continue to be driven by the regulatory need for low-VOC content; isocyanates are potentially the major area of concern running through most areas of PU adhesive use. Although the transport and construction sectors in Western Europe have been impacted by the economic downturn, flexible packaging adhesives have been more resistant to its effects. Manufacturers continue to adapt their packaging in order to reduce waste and weight, so light, flexible and single-use packaging is continuing to grow in demand. Isocyanate migration in areas such as food packaging means that the PU segment is experiencing rising competition from acrylic alternatives.

Eastern Europe represents a key opportunity for suppliers of PU adhesives, mainly through exports. Local production of PU adhesives is weak, but in general Eastern European markets are dominated by a wide range of cheaper adhesives, making conversion to more expensive adhesive use an uphill battle.

Footwear, which is an important segment for PU elastomers, is experiencing a struggle on many fronts as far as the industry is concerned. In addition to the relocation of large parts of the shoemaking industries to Asia, the Western European segment finds that fashion trends are currently going away from polyurethane use, but future short-term trends can always reverse this. TPUs are finding greater use within the mainstream footwear segment as a result of the development of softer grades, advancing their applications beyond sporting footwear. Increasingly, many of the top companies are developing application-specific TPUs for use in different industries.

Binders

PU binders represent a comparatively small market, characterized by little or no regional production outside Western Europe. However, selected countries in Eastern Europe are demonstrating demand growth at about 4% pa in line with growing wood panel production. By contrast, wood panel production in Western Europe has fallen significantly in recent years.This five-volume report is comprised of more than 1,400 pages and more than 900 tables of data. The data includes raw material consumption by product type, by region and by major end-use industry, supported with industry data on production volumes by major manufacturer. Profiles of leading flexible foamers and raw materials manufacturers are also included.

The report is available for the following prices:

Volume 1 - Raw Materials €4,500

Volume 2 - Foam Products €5,500

Volume 3 - Non-Foam Products €3,500

Volume 4 - Major End-Use Markets €3,500

Volume 5 - Executive Summary

THE COMPLETE REPORT €13,500

For more details, contact Mrs. Cathy Galbraith, IAL Consultants, CP House, 97-107 Uxbridge Road, Ealing, London W5 5TL; Telephone +44 (0) 20 88 32 77 80; E-mail cathygalbraith@brg.co.uk; or visit www.ialconsultants.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!