2005 Coatings Industry Report

For 2005, the total coatings industry declined slightly from 2004 by 0.8% in shipment volume of 1,351.8 million gallons compared to the record shipments of the previous year. Shipment value increased 2.9% to $18,537.7, a new all-time record, showing that shipment value kept up with inflation. Table 1 shows the steady growth of the industry over the past 10 years.

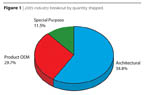

Industry segment breakout results are shown in Figure 1 by shipment volume and in Figure 2 by shipment value for 2005. The relative shares of the three segments remained almost the same as in 2004, (as recalculated using the revised 2004 figures). The data are also shown in Table 2, including the segment totals for 2004 (revised) and 2005.

The Product OEM segment remained almost unchanged from the restated 2004 results. Shipment volume in 2005 of 401.5 million gallons was down 0.7%. Shipment value increased 2.0% to $5,986.3 million, again showing the result of price increases on the cost of shipped products. The economy remained relatively strong in 2005, providing for another fairly good year for the segment. The segment has a 29.7% share of the volume shipped by the industry and a 32.3% share of the shipment value for the industry. The segment had an average $14.91/gallon price of shipments, which is the highest in the past five years.

The information for the rest of this article is taken from a Second Table of the Census Report MA325F(05)-1. Mention of this is made since the totals for each segment differ slightly from the preceding analysis, which was based on the First Table of the Census report. Adjustments are always applied to the former numbers to reflect a total industry estimate. Since the following data, taken from the Second Table of the report, were not revised in the Census report, the analysis may appear confusing. However, the growth rates and relationships remain similar in both parts of the article. Any major differences will be commented on in this report.

Architectural Coatings

In order to better understand the Architectural coatings segment a number of different breakouts are shown and analyzed as follows. Figure 3 shows the breakout of the segment by the major coatings classifications: interior, exterior, waterborne or solventborne. Table 3 also shows this breakout with numbers for both 2004 and 2005, and shipment volumes and values in each classification.

For exterior coatings, waterborne represents 71.3% of the shipment volume, just slightly less than last year. Solventborne exterior remained even with the 2004 volume, but waterborne exterior declined slightly in 2005.

Interior coatings sold in 2005, water- and solventborne, amounted to 64.3% of total architectural coatings, a slight decline from last year. This can be somewhat misleading since many architectural coatings are labeled for both interior/exterior use, thus the reporting may not reflect actual use. Since product labeling has not changed for many years, the year-to-year changes of interior to exterior coatings still point out trends that occur.

Exterior coatings showed a slight improvement and now stand at 34.6% of the total. The exterior market for architectural coatings is obviously still important, and with the decline in home resales, exterior repainting also declines. However, even aluminum- and plastic-sided houses require sprucing up after 15 or 20 years, if only to change the color.

The Census report provides further details of the Architectural coatings segment makeup. The categories are broad and sometimes overlapping. Table 4 shows the breakout of the coatings by the various classifications. The major classification is the finish/top coat, with flat leading, followed by semi-gloss and primers. Due to the rapid dry of waterborne coatings, a high-gloss finish is harder to achieve. Consequently, as more waterborne coatings are used, the amount of high-gloss coatings decreases and semi-gloss increases. This was especially noticeable in 2005.

Primers are important in both interior and exterior applications. However, in 2005, interior primer usage declined significantly from previous years. Exterior primers remained almost the same as in 2004. Total primers were down to 96.6 million gallons from the previous year's 111.4 million gallons, a decrease of 13.3%. All of the primer decrease was due to the interior primer decline. This may indicate that more interior priming is being performed using regular finish coatings.

Stains are primarily used for exterior applications. Oil-based stains are preferred for exterior applications, but waterborne stains are widely used since a number of states are prohibiting solventborne stains. Total waterborne stains represent 57.7% of the total stains shipped, an increase of 2.0% from the previous year.

The size of the ‘Other' category also points out the problem of accurate descriptive end uses for the coatings, since these ‘other' coatings amount to 10.4% of the coating uses. For additional information on the categories, refer to the Census report MA325F(05)-1.

Product OEM Coatings

The Product OEM segment, after significant improvement in 2004, remained almost steady, with a decline in shipment volume of less than 1.0% in 2005. The year 2000 set the record of 456.6 million gallons shipped for the segment. Shipments in 2005 were holding near 400 million gallons, while the restated 2004 shipment level was slightly over 400 million gallons. (Before restating 2004, the total OEM Product shipments had been reported as 424.8 million gallons. This was quite an adjustment for the segment. Almost every category was revised by 5% or more in 2004, most in a downward direction.) Shipment value for the Product OEM segment increased 2.0% to $5,944.8 million. This was the highest level since the year 2000.

In 2005 the individual category results were quite mixed. With the revisions for 2004, some of the changes are even more pronounced. Powder coatings declined from a revised reduction in 2004. Almost all sub categories of powder coatings lost ground in 2005. Automotive coatings declined in 2005 after a revised increase in 2004. Wood and non-wood furniture etc., grew in 2005 over minor upward revisions in 2004. Other OEM coatings (General Metals) declined from a reduced 2004 level. Other Transportation (including railroad and aircraft) showed a good increase from a revised reduction in 2004. A more detailed description of each category is presented below in the section on Coatings by Related Groups.

The 10 largest categories included in the Product OEM segment for 2005 are shown in Table 5 listed in terms of volume shipped and product value.

Special Purpose Coatings

Special Purpose coatings grew 0.7% in volume over the 2004 results to 155.6 million gallons. Shipment value grew 3.1% to $3,631.8 million, which is the highest amount ever of sales dollars for the segment. Shipment volume has been higher in previous years, but the value has never been higher. The 2005 results for volume shipped, as mentioned, were very close to the previous year's revised results. The previous year had only a few revisions, but the revisions reduced the total segment volume as previously reported in 2004 by 10.8%, or almost 20 million gallons.

The quarterly reports have consistently reported lower shipments, and almost every year the annual report revises the data to higher levels, even for the previous year. For 2005, the quarterly report volume numbers were quite close throughout the year with the 2004 results, and both years were reduced by 10% in volume when the annual report came out. The actual level of shipment volume continues to be a mystery. It is difficult to analyze the segment meaningfully since the numbers change from report to report.

The 173 million gallon level reported originally in 2004 seemed to be appropriate for the segment since it appeared to be about the average volume shipped over the years, (over the past 16 years the average volume shipped for the segment has been 175.5 million gallons). Now, however, shipment volume level has settled on 155 million gallons. Shipment value does not vary much between the reports. The revisions this year occurred in the High Performance and Traffic Marking categories. Both categories indicated increased volume in 2005 based on the reduced prior year shipment volume.

The Special Purpose categories making up the segment can be seen in their relative size in Table 6 for volume and value respectively for 2005.

Another way of looking at the various categories in the Product OEM and the Special Purpose Coatings is to group them according to the markets where the coatings are sold. Table 7 shows five groups that have been chosen to represent the categories of these two segments. Shown in the table are the volume and value of shipments for both 2004 and 2005. The table illustrates the size of the various related market groups. To view the makeup of the various groups, a separate section follows for each group.

Transportation-Related Group

The Transportation group, comprised of eight categories, represents the largest group. All the coatings have a direct relationship to the transportation market, including a few categories from the Special Purpose coatings. Table 8 shows all these categories for 2004 and 2005.

The total Transportation group had very little change between the restated 2004 and the 2005 results. Total shipment volume for this group declined by less than 0.5%, and shipment value increased by 0.5%. The Transportation group of coating categories, with $4,269.1 million, represents 45% of the shipment value for the Product OEM and Special Purpose coatings segments. The shipment volume represents 32% of the volume of the two segments. The price per gallon for this group of categories is $23.94/gallon, which is quite high for the total industry. Transportation-related markets are an important coating end user.

Cars, Light Trucks and SUV, and Automotive Parts, categories follow closely the trends of the U.S. automotive manufacturers. Both 2004 and 2005 were about equal in production output. Although the major U.S. auto manufacturers are hurting, the foreign transplants are producing many more automobiles. Shipment volume and value for the category were also very close. The Cars, Light Trucks and SUV category had a value of $20.92/gallon, while the Automotive Parts category had a value of $33.08/gallon. The latter value is due to the number of very specialized coatings required by the parts manufacturers, such as scratch-resistant lens coatings, fastener coatings, small plastic part coatings, etc. The relatively small coating volume used in these applications, together with the need for long-life effectiveness, provides for the premium paid for the coatings. Fortunately, the Cars, Light Truck and SUV category coatings for the transplant cars are mostly manufactured in the United States rather than imported.

Heavy Duty Trucks and Bus gained 8.6% in volume shipped, with shipment value increasing 13.0%. This was after a large reduction in the 2004 figure due to the restating of data. (Apparently, the 2004 numbers reported last year had some double reporting that was not caught last year and was corrected with the 2005 reports.) Shipment volume and value still appear low when looking at the economy.

In 2005, the Other Transportation category, including aircraft, railroad and other transportation coatings, increased by 18.5% in both volume and value shipped. Currently, the aircraft industry is becoming more active with new plane production and more refinished planes. The category should continue growing during the next year as more railroad and aircraft are needed to support the war and the expanding economy.

The Automotive Powder Coatings category continued to show very depressing numbers. The volume shipped declined by 28% over the reduced 2004 numbers. There were major acquisitions that took place in the powder coatings industry in the past couple of years that may have adversely affected the reporting to Census. It is also possible that the data for automotive powder was reported in the wrong category, or not reported at all. The potential of automotive powder coatings is still large, but alternate technologies keep improving and holding powder to small niche markets. If, and when, powder breaks out of its niche markets, shipments should expand.

Marine coatings in 2005 improved by 1.6% to almost normal levels of production. This is one of the few categories that was not restated for 2004. The U.S. producers do not supply the manufacturers of new, large ships that are produced in other countries. The larger U.S. coatings manufacturers have foreign operations that supply the offshore marine industry. Off-shore oil facilities in U.S. territories should require a considerable amount of repair and maintenance coatings (part of this category) after the hurricane season of 2005.

Automotive refinishing had another good year, with a small decline of 3.2% in volume shipped and a decline of 0.9% in shipment value. These two years showed the best results since 2000, and almost up to record levels achieved in the late 1990s. This was another category where the 2004 results were not restated. It continued to be a good year for auto repair, refinishing and fleet painting. With the expanding number of automobiles owned in the United Staes, the need for repair and refinishing continues to grow. The bad weather in 2005 likely played a role in the need for auto refinishing. Coating price was $37.26/gallon in 2005, almost the highest for any category in the paint industry.

Highway and Traffic Marking paints increased about 5.5% in both volume and value of shipments in 2005, from a restated reduction of the 2004 results. The greater availability of Federal, State and local funds for highway maintenance continues to have a positive effect on traffic marking paints. The category still has room for future growth, although alternate stripping technologies may reduce the growth of liquid coatings.

Building and Construction-Related Group

The Building and Construction group, shown in Table 9, includes five coating categories that relate directly to the building and construction markets. Overall this group grew in volume shipped by 7.3% in 2005 and shipment value increased 10.9%. The group represents 28.5% of the combined Product OEM and Special Purpose segments. Most of the categories in the group improved except the Wood and Composition Flat Stock, and the Architectural powder categories, which both showed small declines from 2004. The High Performance and Maintenance category was the only one that had restated prior year results. This category always seems to have its prior year results restated.

Both the Wood and the Non-Wood Furniture and Fixtures categories had good growth in 2005. There were no restatements in 2004 for either category. Wood furniture increased 9.6% in volume shipped and 14.7% in shipment value. Non-wood furniture and fixtures increased 12.3% in volume shipped and 13.0% in shipment value. Both of these categories are reaching the level of sales that were last seen in the late 1990s for wood and the early 2000s for non-wood. The economy must be helping companies refurbish and expand their offices.

Wood and Composition Flat Stock did not perform as well as the previous two categories. Shipment volume declined 5.9% although shipment value showed an increase of 4.4%. This category is tied closely to the home construction market and may reflect the softness of new home construction.

The High-Performance coating category increased in shipment volume 4.5% from a restated 2004 level, which was lower than the originally reported amount. This category traditionally is restated each year when the new annual report is released. There is some problem with the way the companies making up the category report from year to year and quarter to quarter. Shipment value also increased 9.0% from 2004. These high-performance coatings have a high unit value of $19.83/gallon. High-performance coatings may be benefiting from the improved construction and remodeling economy and should also be helped with repair and maintenance following the weather-related destruction in 2005.

Architectural powder declined by 11.0% in shipment volume from the previous year. This category has not grown over the past 10 years as far as the reporting indicates. There is a chance that some powder coatings manufacturers do not report to the Census, or report in the wrong categories or as General Metal powder.

The Machinery and Equipment group consists of four coating categories where the products coated are machinery or equipment. Table 10 shows the comparison of the various categories.

The Appliance coating segment is made up of both liquid and powder coatings. The usage has been fairly close to equal, with powder coating leading. For the last several years though powder coatings have been declining more than liquid coatings so that now liquid coatings have a slight advantage. Both liquid and powder coatings were adjusted downward in 2004, with appliance coatings taking the bigger hit. Shipment value of both liquid and powder coatings declined about 10% in 2005. The unit value of powder is $21.14/gallon or about $4.23/pound. Liquid coatings had a unit value of $11.33/gallon. Powder coatings have a greater coating efficiency than liquid coatings. When reporting returns to a more consistent level, the two should continue to be about equal in volume shipped. Importation of finished appliances is reducing the need for U.S.-manufactured coatings.

The machinery and equipment category decreased 1.9% from the previous year. The 2004 adjustment eliminated about half of the large increase of the previous year. The current 20 million gallon shipment level still ranks at the top of usage in the past 24 years. Shipment value in 2005 is the highest for this category in over 20 years. Large machinery and equipment is still being made and coated in the United States.

Lawn and Garden powder volume shipments in 2005 decreased by 11% from 2004. There were no adjustments to the 2004 number, so the decline in shipments indicates a decline in powder coatings for this market. Again, the powder coating reporting to Census may not be accurate.

The Metal Products coatings group represents five categories that are used on metal, although they may be used by a variety of industries. This group has declined 5.1% in volume so that it is now slightly behind the Building and Construction group of coatings, thus putting it in third place. It is also in third place in shipment value since the Building and Construction group increased in 2005 in value shipped while the Metal Products group declined by 1.8%. The makeup of this group is shown in Table 11.

The Containers and Closures category increased slightly by 0.6% in volume shipped, whereas the value increased 5.0% in 2005. Shipment value in 2005 is the highest since 1998, even though shipment volume has declined. The container market, although growing slightly each year in numbers of units coated, continues to be more efficient in its use of coatings.

Coil, Sheet and Strip coatings declined by 3.3% in 2005 in volume shipped, with a decline in shipment value of 5.6%. This category is having a hard time growing the market for precoated metal. New markets for coil-coated products are not being developed fast enough to help the category grow as older markets lose coating share to other technologies.

The General Metal category is a large category for both liquid and powder coatings. It includes all the miscellaneous coatings that are primarily used on metal products that do not have another category to report them. For 2005, the liquid category was down by 12.8% in shipment volume from the previous year, while shipment value increased 5.3%. The General Metal powder coatings category remained equal with 2004 in volume shipped while decreasing in shipment value by 11.5%. More small products that are prefinished are being imported.

The Thermoset Functional and Thermoplastic Powder coatings category declined by 6.3% in volume shipped in 2005, while shipment value declined only 1.0%. Due to the few reporting companies for the two parts of this category, thermoset functional and thermoplastic powder coatings are not reported individually by Census. Data for the category is derived by difference from the total powder coatings shipped and the powder shipments reported in the other powder categories. The Thermoplastic category is mostly for decorative purposes as opposed to the thermoset powder, which is used for functional purposes. It would be good to have these two categories reported separately, but Census rules do not permit publishing data that would reveal individual company results directly or indirectly.

The Miscellaneous group consists of four categories that do not fit in with the above groupings. Table 12 includes the remaining categories of both the Product OEM and the Special Purpose coatings segments. The group is relatively small, and although the combined volume of shipments declined by 6.9%, shipment value increased 11.0%, a respectable increase.

The Electrical Insulation coatings category continued the decline that began last year. It is likely the result of mergers or acquisitions that have taken place in the industry. The consolidation of electrical insulation coating manufacturers and the spin-off of some businesses may be adversely affecting the reporting of data to the Census department. Although shipment volume declined by over 50%, shipment value declined only 9.8%. It is doubtful that this category will be broken out separately in future years as the number of separate reporting entities is reduced.

The Paper, Film and Foil coating category declined in 2005 in shipment volume by 4.5% while shipment value increased 3.1%. This is not a bad showing for the category. The value per gallon of coatings shipped increased to $9.11. Except for a number of years during the 1990s, the current volume of shipments is about average for the category. Only three previous years in the 1990s exceeded the current value of shipments.

The Aerosol coating category declined in volume shipped in 2005 by 11.9% while shipment value increased 3.8%. The category has been hampered in recent years by restrictive anti-graffiti laws, which limit the sales of aerosol products.

The Other Special Purpose coatings are those that could not be classified into other categories of the segment. The category increased in 2005 by double in volume shipped. Shipment value increased by 2.5 times from 2004. The Other Special Purpose products, although quite small in volume, did have a $37.92 price per gallon, which is quite high and indicates small volumes of highly specialized coatings.

Powder Coatings

Powder coatings have been mentioned in the various groups above. Powder coatings are reported in pounds to Census and converted to gallons using a 5 pound/gallon conversion factor. For 2005, 323.9 million pounds were reported, a decrease of 5.9% from 2004, which had restated the volume to 344.2 million pounds. Powder coatings are no longer growing as fast as they once did. Markets that can use powder coatings efficiently and economically have switched over from liquid coatings. However, liquid coatings have made technological advances in the past few years and are preventing further penetration of the market for metal products. Consolidations continue to occur in the powder coating industry, which could effect the reporting. The future could be quite attractive, but depends on large customers investing in new coatings facilities. This is slowing down the growth of powder coating usage.

Caveats

Each year the U.S. Census Bureau collects data from establishments in the coatings industry having 20 or more employees. These establishments represent approximately 95% of the total value of industry shipments. Inaccurate or lack of reporting resulting from mergers, acquisitions or divestitures affects the results of the survey. However, the data collected is still regarded as the best estimate of the coatings industry's performance. The report is published as part of the Census Bureau's Current Industrial Reports, as MA325F(05)-1, issued June, 2006. The article contains an analysis of the current data compared to data from the 25 previous years, together with knowledge of the makeup of the coatings industry.

Sidebar: The Annual report from the Census Bureau collects data from a large sample of paint manufacturing plants each year with data for the current year and the previous year. This usually causes adjustments to the previous year's data as previously reported. The 2005 Annual report was no exception; although the overall adjustments were relatively small, there were more adjustments than usual and especially in the Product OEM Coatings segment.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!