U.S. Manufacturing Technology Orders Surge in June

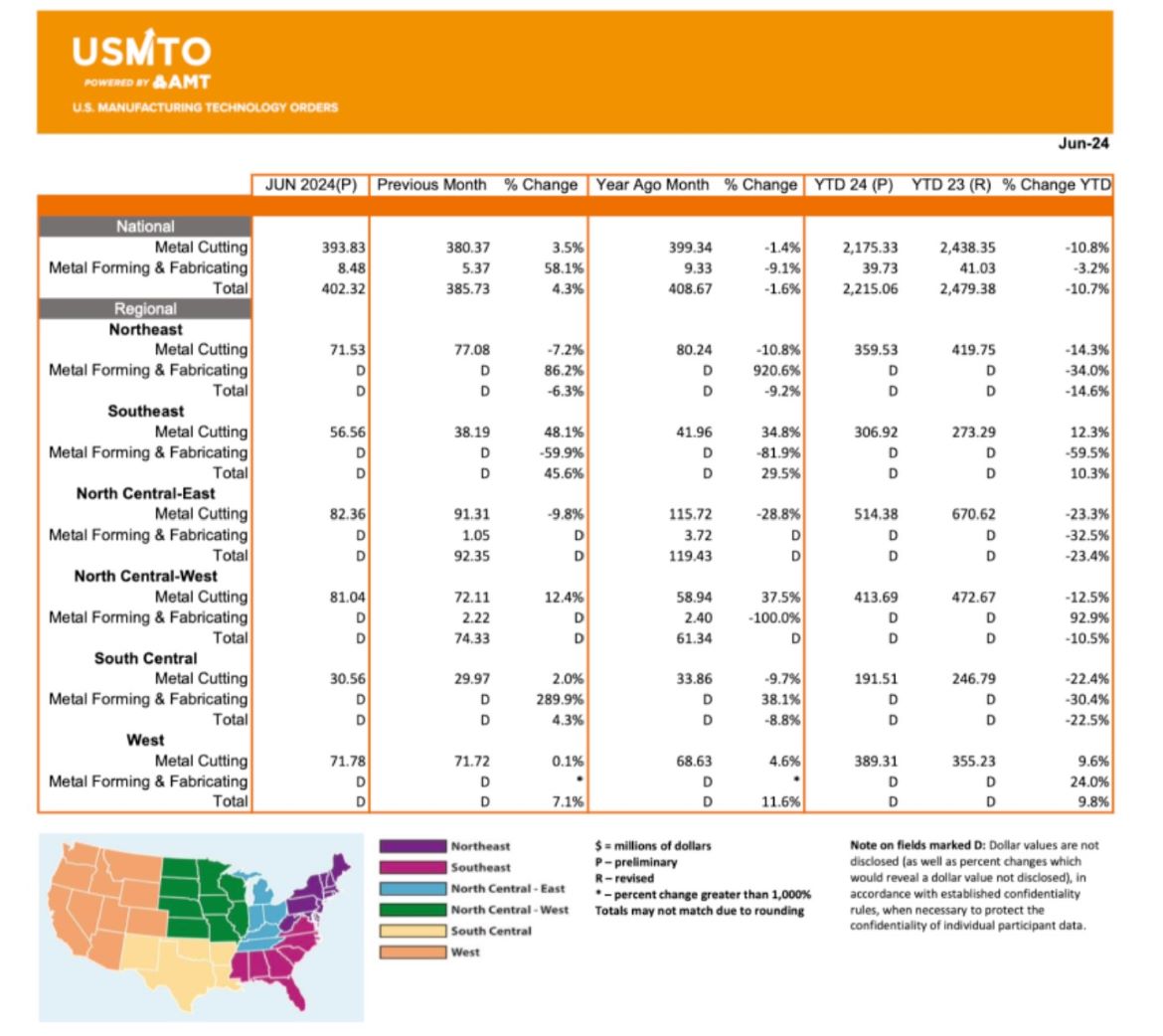

Image courtesy of the U.S. Manufacturing Technology Orders Report Orders published by the Association for Manufacturing Technology.

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders (USMTO) report published by AMT – The Association For Manufacturing Technology, totaled $402.3 million in June 2024. New orders of metalworking machinery were up 4.3% from May 2024 but down 1.6% from June 2023. Year-to-date orders reached $2.2 billion, down 10.7% compared to the first half of 2023.

While the value of orders maintained momentum in June 2024, with the average value increasing significantly, the number of units ordered for the month dropped to 1,471 units, the lowest since July 2023. This divergence indicates manufacturers are generally investing in more automated, task-specific solutions. This trend is further confirmed, as inflation among machine tools, measured by the producer price index, has stayed relatively flat for the last several months.

June 2024 orders from contract machine shops dropped over 10% from May 2024 in both the number of units ordered and the total order value. Through the first half of the year, the value of these orders was the lowest since the first half of 2020, but the number of units ordered fell further, reaching its lowest level since the first half of 2010.

Primary metal manufacturers have also pulled back machinery orders in 2024, dropping to the lowest levels in both unit count and value since the first half of 2010. Demand for machinery in this sector has been waning, as the World Steel Association reports that global steel production in the first half of 2024 was flat compared to the first half of 2023.

-

One notable exception to this recent trend is the aerospace sector, which has increased orders in the first half of 2024 to the highest number of units since the first half of 2018, yet the value of orders remains about 2% below orders placed in the first half of 2022. With capacity utilization in the aerospace sector reaching post-COVID peaks, this confirms that these manufacturers are in need of additional machinery to meet growing demand.

Orders of manufacturing technology are down nearly 11% in the first half of 2024 compared to 2023, but that difference has narrowed in the past several months after the beginning of the year failed to meet the optimistic expectations formed from anticipated interest rate cuts and strengthened consumer and business sentiment. Despite the lingering uncertainty around the Federal Reserve’s interest rate policy, the pending election, and escalating geopolitical tensions, the remainder of 2024 seems ready for a rebound in demand for manufacturing technology – perhaps even more so with the opening of IMTS 2024 – The International Manufacturing Technology Show in Septemberin Chicago.

Read more about the report here: https://www.amtonline.org/article/manufacturing-technology-orders-grow-4-3-in-june-2024-as-year-over-year.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!