Trust in Paint Brand and Retailer Now Major Indicators of Customer Satisfaction

Painting a home is one of the most common, yet impactful home improvement projects consumers undertake. Manufacturers rely heavily on loyalty in terms of both repeat purchases and positive recommendations. Loyalty can only be achieved by truly understanding customers’ attitudes, preferences, and ultimately delivering an outstanding customer experience.

The J.D. Power Paint Satisfaction StudySM examines key drivers of satisfaction among customers who purchased and applied interior paint, exterior paint, interior stain, and/or exterior stain. The 2024 study has been released, and is based on responses from 6,892 customers who purchased and applied these products in the past 12 months. The study was fielded from January 2024 through February 2024.

The study, which provides the paint industry with insights into the evolving needs and demands of customers, includes the following objectives (organized by study segment):

Interior Paint, Exterior Paint, Interior Stain, and Exterior Stain Segments

- Measures key drivers of satisfaction among customers who purchased and applied interior paint, exterior paint, interior stain, and/or exterior stain;

- Examines pathway to purchase;

- Captures application behaviors;

- Examines problems experienced;

- Delivers insight into what drives customer loyalty.

Paint Retailer Segment

- Captures brand image and reputation;

- Measures key drivers of satisfaction among customers who purchased interior/exterior paint or interior/exterior stain from a major paint retailer;

- Captures online and in-store experience;

- Delivers insight into what drives customer loyalty.

According to Michael Taylor, Senior Managing Director of Retail Intelligence Practice at J.D. Power, the study measures seven dimensions of interior/exterior paint or interior/exterior stain usage: level of trust, adequacy of coverage, variety of offerings, ease of cleaning surfaces, durability, ease of application, and value given for price paid. The study also examines the customer experience with their paint retailer based on online experience, in-store experience, service and staff, merchandise, and price.

According to the study, when it comes to purchasing paint, it serves shoppers well to do their research beforehand to ensure an understanding of what they want and need—and then engage a retailer to get advice and recommendations. Then, it’s up to the paint brand and paint retailer to deliver on those expectations by establishing trust throughout the shopping and purchase process.

For example, if a sales associate provided very helpful suggestions, trust satisfaction is 791 (on a 1,000- point scale) vs. 616 when suggestions are not completely helpful. Even as the customer heads out the door, if they are thanked by the sales associate, trust scores are 770 vs. 596 if they were not thanked.

“Listening to the customer and providing relevant product information makes a difference,” said Taylor. “Explaining product benefits and features, keeping the store clean, having supplies at the ready, providing suggestions, and interacting in a positive way with customers goes a long way for both the product itself and the retailer,” he added.

“When a customer trusts the retailer it relieves a lot of anxiety, as they are much more confident in their purchase. They want to know what is needed to be successful with the project they are taking on. Painting is a long-term investment for the consumer and they are looking for information that makes it easier to paint, easier to hide imperfections, and resist stains… in other words, which brands/retailers make it easy for me so that I won’t have to paint walls again any time soon?” Taylor added.

The study also found that past experience with a paint brand is also a critical driver of paint brand choice. “If a customer has a good experience with either a paint retailer and/or the brand they painted with for their last project, they are extremely likely to take the same approach for the next project. That experience was even more important than the brand offering the color that (the purchaser) wanted.

Study Rankings

Below are some of the rankings based on this year’s study.

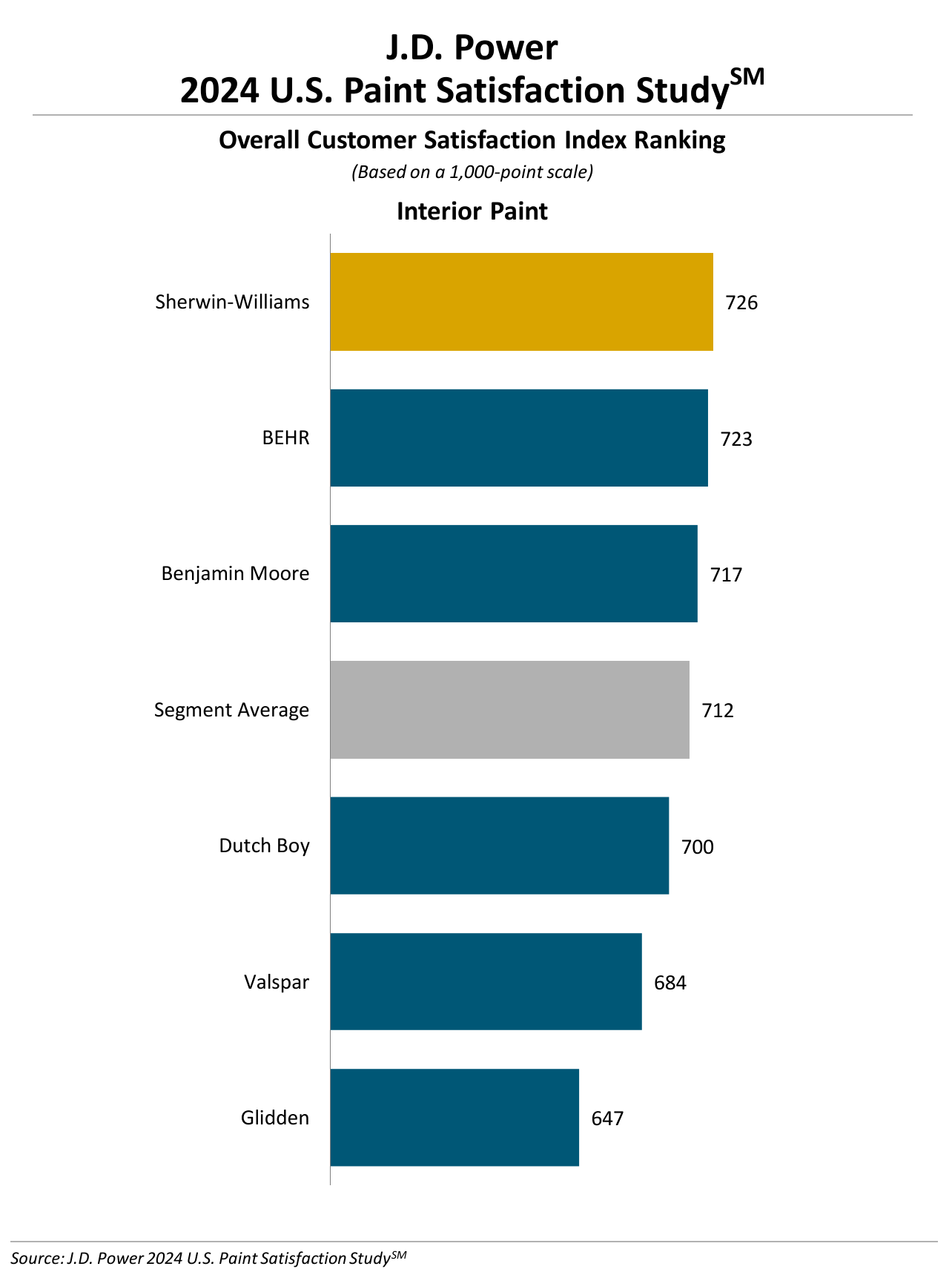

- Sherwin-Williams ranks highest in the interior paint segment with a score of 726. BEHR (723) ranks second, and Benjamin Moore (717) ranks third.

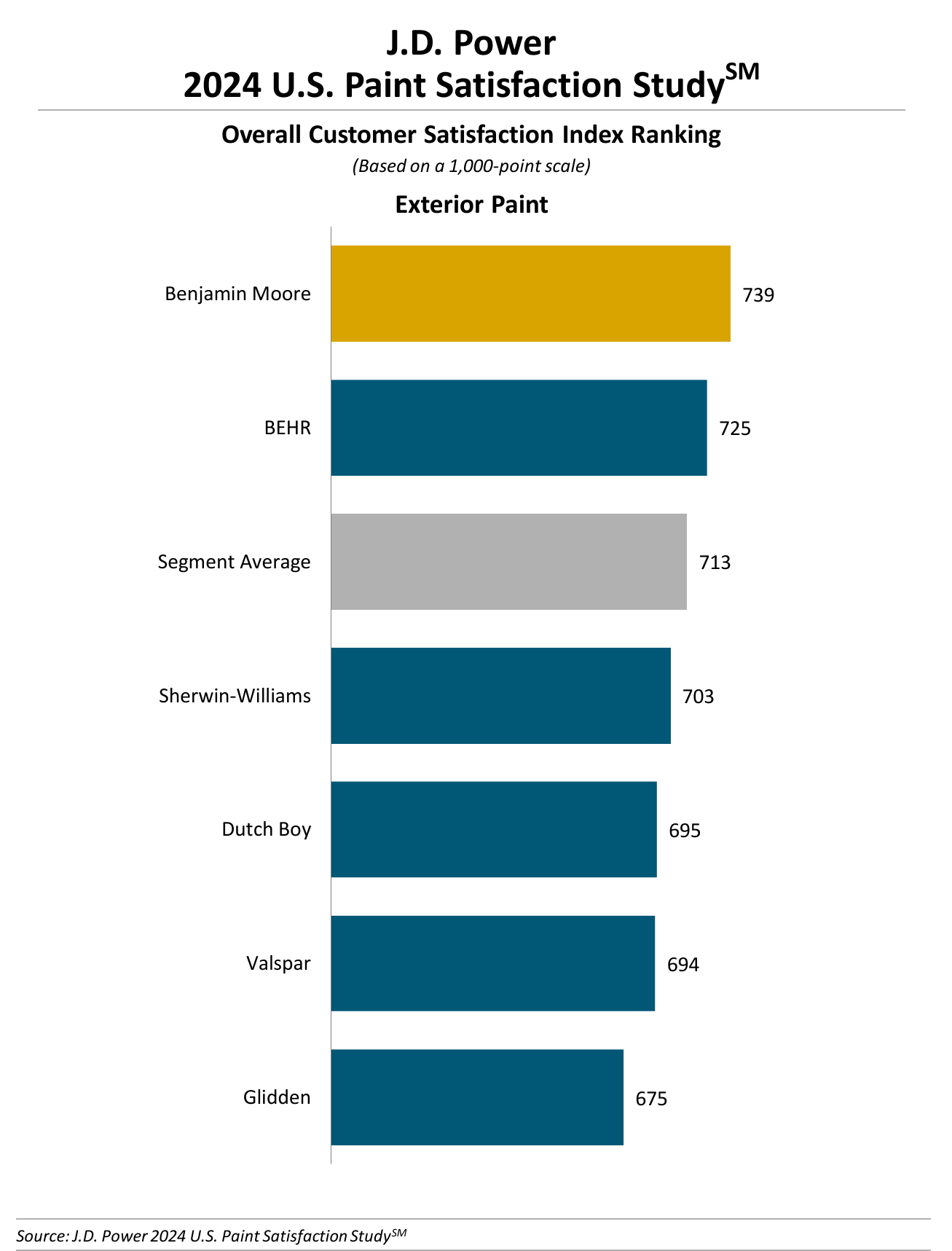

- Benjamin Moore ranks highest in the exterior paint segment with a score of 739. BEHR (725) ranks second. The segment average is 713.

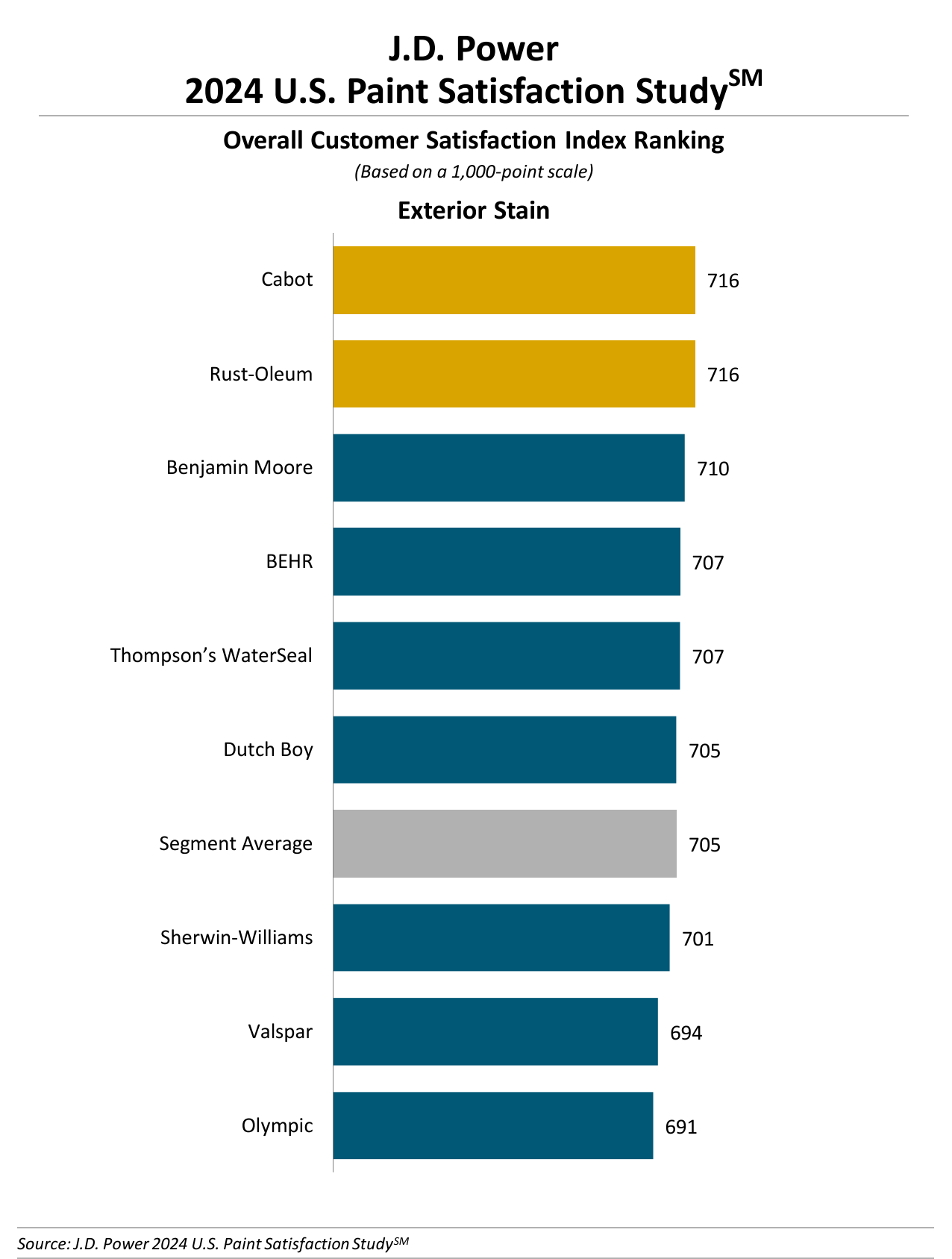

- Cabot and Rust-Oleum rank highest in a tie in the exterior stain segment, each with a score of 716. Benjamin Moore (710) ranks third.

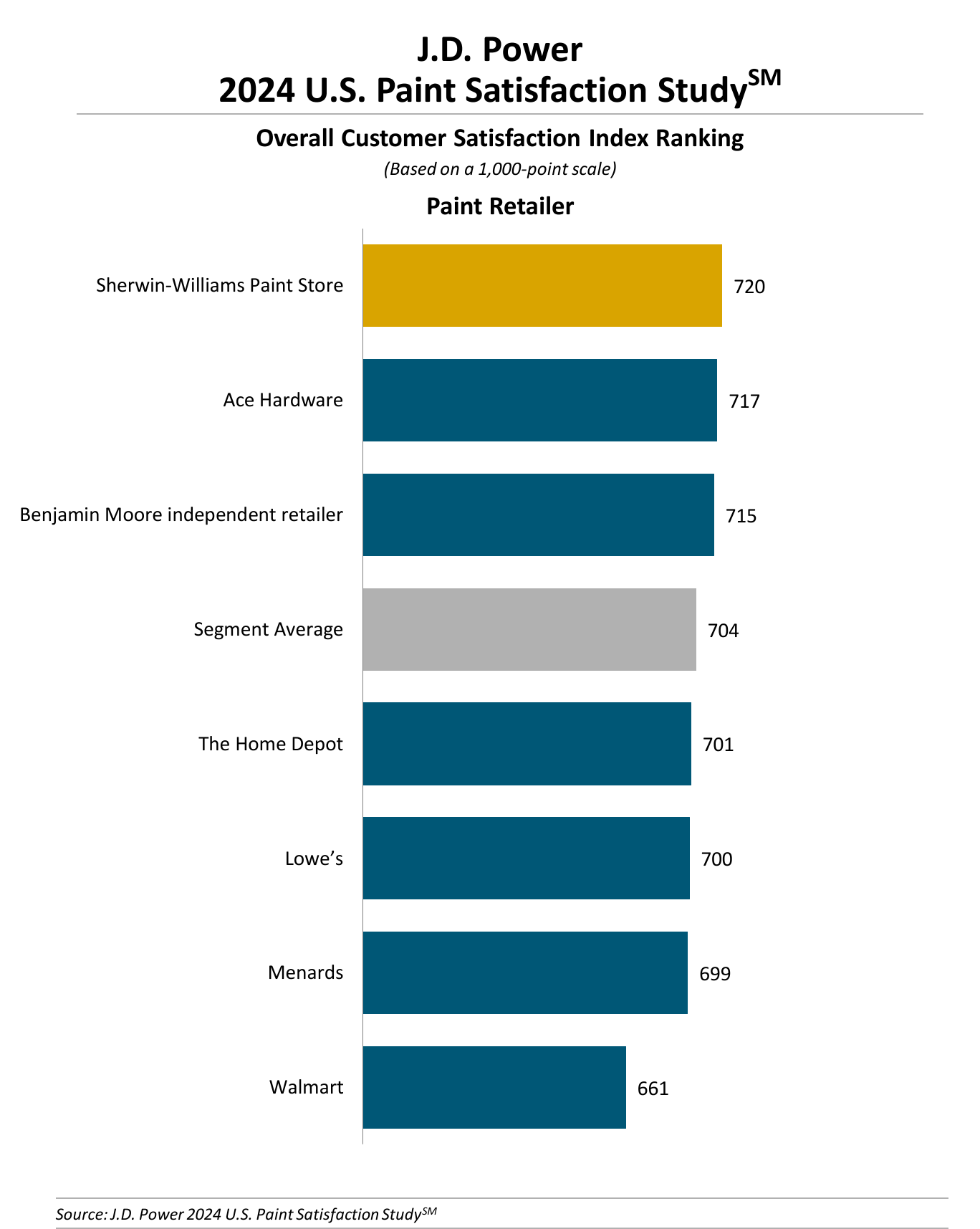

- Sherwin-Williams Paint Store ranks highest in the paint retailer segment with a score of 720. Ace Hardware (717) ranks second, and Benjamin Moore independent retailer (715) ranks third.

For more information about the U.S. Paint Satisfaction Study, click here.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!