Coatings Raw Materials Following the Supply Chain Crisis

Current and Future Outlook

kokouu, E+, via Getty Images.

In 2019, no one in the coatings industry expressed any concern about raw material supplies and availability. Then COVID and the global supply chain crisis hit with a one-two punch and disrupted essentially all aspects of daily life on a global scale, not only for the population at large but for both global industries and governments as well. For two solid years, chaos reigned. We are now more than halfway through 2023, and while both the paint and coatings business—and the raw material supply chain upon which it is built—seem to be back to some semblance of “normal,” what we are experiencing in 2023 is not what we were experiencing in 2019. Not by a long shot.

In 2023, we are heading in the direction of those halcyon days of yore, but not without a number of lingering raw material, logistics, and labor issues. It is true that only a handful of raw materials are difficult to obtain, and the ones that are problematic tend to be special materials used in relatively small quantities by a limited number of coatings producers. Nonetheless, despite the outward appearance of “normality,” there are still issues with raw material production, pricing, transportation, and delivery.

No one in 2019 would have predicted a supply chain crisis in the near future, nor do many raw material suppliers, distributors, and coatings producers expect to see significant supply chain disruptions during 2023 or 2024. However, unlike 2019, they tend to temper this expectation by adding one or more of the following qualifying phrases, “Assuming that. . .

- . . .interest rates continue to drop.”

- . . .neither Russian nor Chinese actions disrupt the global supply chain.”

- . . .we do not have a recession.”

Raw Materials Trends

January of this year was characterized by the de-stocking of raw materials held in the paint companies’ warehouses, with spillover into February. Things began picking up for raw material orders in late February, and the overall industry, along with its supply chain partners, exhibited solid (but certainly not outstanding) performance by the end of Q2 2023e (e=estimated). While there seems to be a general consensus among both the raw material suppliers and the coatings producers in the majority of market segments that Q3e-Q4e will perform marginally better, we still anticipate an overall decrease in U.S. volume of 1.5% in 2023e but an increase in value of 5.3%, as formulators seek margin improvement from a five-year industry low in 2022.

Prices for epoxy resins, which are now available both from sources in APAC as well as domestic suppliers (as are the diamines necessary for 2K epoxy systems), have come down notably from their dizzying highs in 2021 through mid-2022. For acrylic and modified-acrylic emulsions, supply and demand seem to be in balance for most products. Alkyds are still somewhat difficult to obtain “on time and in full,” and are likely to become only marginally more available for the remainder of the year. While alkyds only comprise approximately 5% of all U.S. paint and coatings production, they continue to hold their own and may very well experience enhanced market share in the decade ahead, given the “bio component” of alkyds and the work in university, coatings manufacturer, and independent research organization laboratories to take advantage of the “green content” that alkyds offer.

Poly(vinylidene)difluoride (PVDF) resin was in critically short supply in 2021 and Q1-2 of 2022, and prices rose on the order of 200-300%. This was fueled largely by two fast-growing uses for this resin that do not fall within the coatings area: transfer tubing and containment for absolutely pure water used in the production of semiconductor chips; and in the manufacturing of electric vehicle (EV) batteries, where the dielectric properties of PVDF are valuable in making membranes that permit the migration of lithium ions.

Mined fillers (e.g., clays and talcs) are in balanced supply, as are inorganic chromatic pigments. Solvents are readily available, and additives, which were profoundly afflicted with shortages during the past two years, are back in reasonable shape, although many coatings producers have indicated that there are still periodic problems obtaining certain additives.

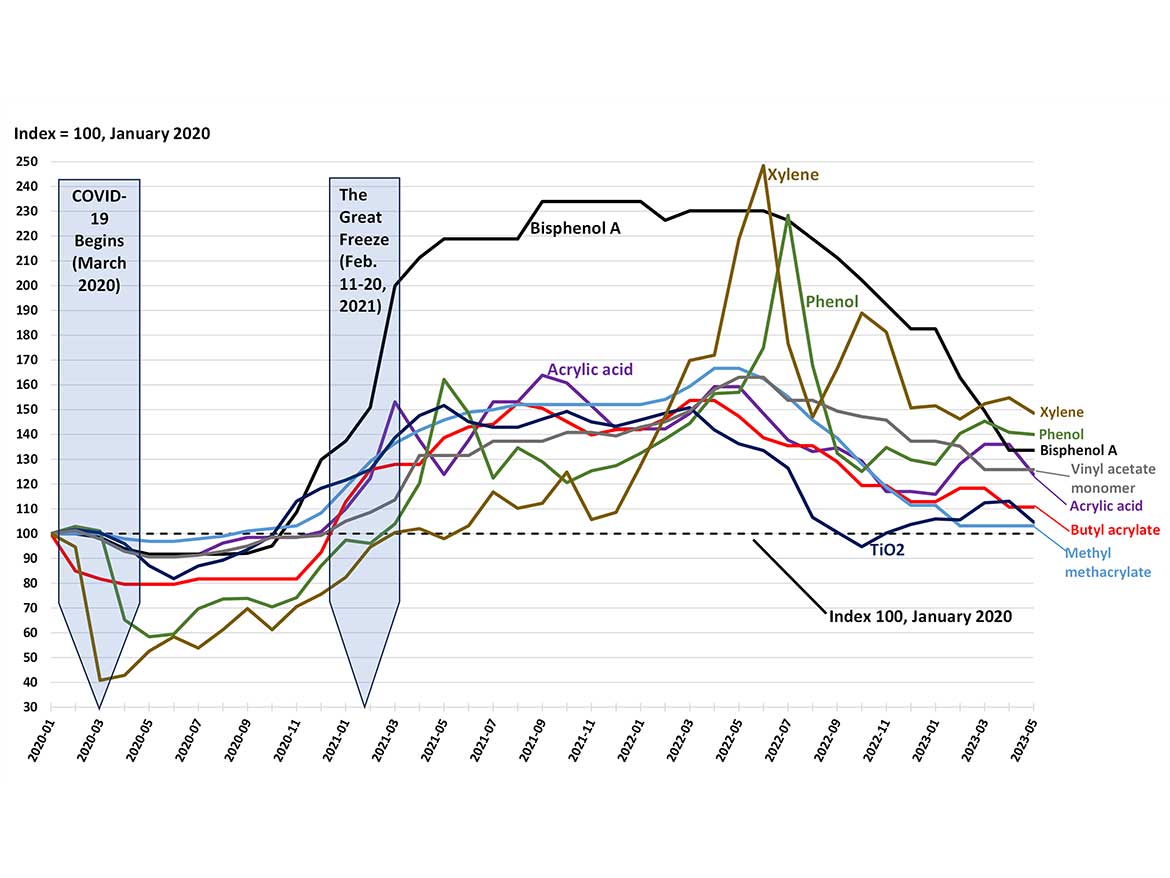

Titanium dioxide is in widespread use in many coatings industry segments; sales were very strong during the first half of 2022 but then decreased dramatically during the second half of the year. This was for several reasons, principal among which was the weakening demand for paints and coatings, accompanied by destocking on a global basis, both of which contributed to a lackluster Q1 2023e (Fig. 1).

For the industry as a whole, the R/M cost increase for an average basket of coatings raw materials between Q4 2019 and Q3 2022 was roughly +40-50% (and even higher for certain products). With the arrival of Q4 2022, the coatings industry witnessed a marked slowing in raw material demand, coupled with high inflation (stagflation). The raw material shortages of 2021-2022 had given way to high raw material inventories, which resulted in destocking by both the raw material producers and their coatings customers.

Very early in Q1 2023e, some raw material producers put through a final round of raw material price increases, but—on the whole—the pressure on major feedstocks helped to stabilize pricing. Downward pressure on raw materials was working, although it has, in most instances, not been nearly as effective at lowering raw material prices as the previous 20 months of supply chain problems had been at increasing them. It is likely that 2023e will see a reduction of 10-15% for a basket of raw materials, although specific raw materials may decrease at different rates, and some might increase. Price increases (if any) are likely to be restricted to a few specialty items, although much depends on the degree to which the Federal Reserve can control inflation.

Transportation Dynamics

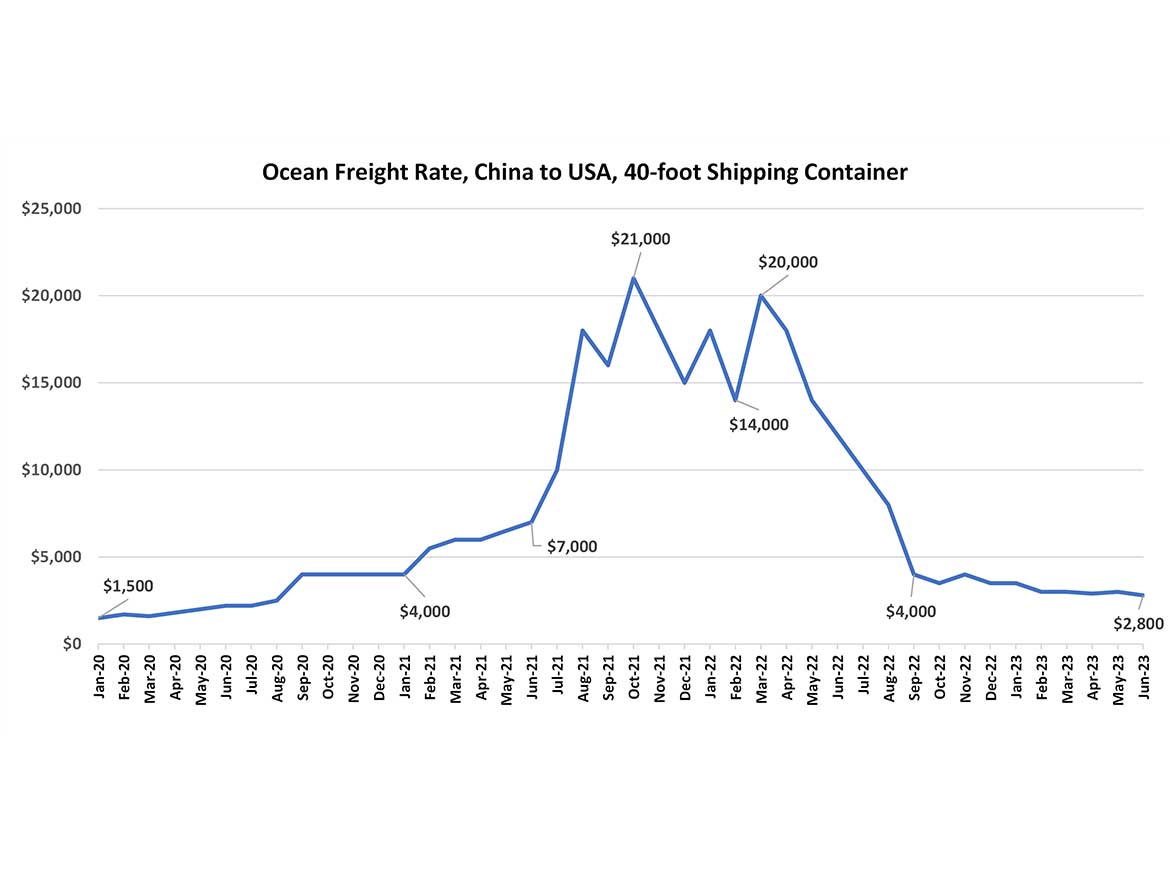

A significant contributor to the cost of raw materials over the past two years has been the skyrocketing costs of both transoceanic and domestic transportation, both of which hit unprecedented heights during the first half of 2022. In the first half of 2023, the cost for transoceanic shipping steadily trended downward, although cost of shipment can vary significantly depending upon country of origin, type of material, and destination port.

Domestically, much of the difficulty obtaining both trucks and drivers experienced during 2021-2022 has been resolved, although cost to ship has dropped much less than any of us had hoped. In any event, no one should get too comfortable—current availability of domestic trucking has less to do with augmented truck fleets and additional drivers and more to do with a temporary decrease in shipping needs (Figures 2 and 3).

What Lessons Have We Learned?

For those coatings producers and raw material suppliers that have learned important lessons from the supply chain debacle of 2021-2022, business will not proceed “as usual,” if we define “usual” to mean the ways in which component raw materials were ordered, purchased, priced, sourced, transported, and inventoried prior to the year 2020. We have seen the dangers inherent in “just in time” (JIT) delivery and have been brought face-to-face with the harsh reality that many raw materials that are critical to the U.S. coatings market have been sourced (sometimes exclusively) from outside of the United States and especially from China, with which our political relationship appears to be in decline. Reshoring and nearshoring should be the order of the day, especially for higher risk, critical-path products.

Greater focus on local and/or regional (within the United States) suppliers is also an area that should be given serious thought. Not only will shorter travel distances reduce freight costs, but during future periods when the supply of trucks and/or drivers is at a premium, local/regional supply chains should make it easier to arrange for logistics that are as reliable as possible. Moreover, purchasing from local and regional suppliers will enable the cultivation of relationships that will enhance communications during times when raw material availability and/or transportation disruptions are making life difficult for both supplier and customer alike, potentially helping both parties to be more proactive with their planning and sourcing needs.

The overall paint and coatings industry, along with its supplier base, has learned that tactics are important to optimize the ongoing operation of our manufacturing facilities, but it also needs to recognize that tactics alone are not sufficient as we move into the future. They must be accompanied by strategy, because the future is likely to be increasingly uncertain for global industry in general. The only way we can be as prepared as possible to deal with future uncertainties is by putting strategic plans and systems in place that are able to anticipate future disruptions of various types, as well as creating long-term plans for both avoiding such disruptions and for dealing with them if they cannot be avoided.1 We cannot continue into the future as we have in the past.

A prime example is inventory control, which has certain tactical aspects but should be governed by a strategy that takes as many unanticipated future events into consideration as possible. The coatings manufacturers and raw material suppliers that are serious about avoiding too much or too little inventory are already working onnew initiatives to assist inventory management one or more steps both upstream and downstream to avoid surprises and improve planning.

Speaking in January with Time magazine Editor-in-Chief Edward Felsenthal, Klaus Schwab, distinguished Founder and Chairperson of the World Economic Forum, indicated that, “We are in a restructuring of the global economy. When you have a restructuring in a company, you write off the costs on your balance sheet, and shareholders are suffering and sometimes employees have to go. But when you have a restructuring of an economy, it bites into the purchasing power of the people. We should not look at the global economy with a crisis mindset and a short-term approach. We have to manage in a strategic transformation period, which may last three, four, five years and will be socially very painful.”2

The entire global community, not just the United States, will be “restructured” to one degree or another—every industry in every country will need to ask, “Where have we been?” and “Where do we need to be headed?” If the past three-year period has taught the industrialized world one thing, it is that no manufacturing business can afford to keep all of its eggs in one basket—single-sourcing from raw material producers is dangerous; single-sourcing from individual countries is even more so; and failing to source at least some portion of as many raw materials as possible from the geographic region in which you are situated is akin to praying on bended knee for something bad to happen.3

JIT may or may not be dead, but it is certainly in the process of being rethought. It can only work when one link in the chain is the focal point—it cannot work when multiple members of the supply chain all want JIT from their vendors.

What Will Become of R&D Efforts in the Coatings Industry?

Coatings is a technology-based, global industry, and those with a strategy focused on the continual development of new and improved products will ultimately come out on top. The past three years have shown that it is certainly important to have an ongoing technical effort to investigate potential raw material substitutions and have product names, specifications, and instructions for use readily available in the case of shortages. However, even when all hands are on deck trying to put out fires, absolutely nothing should prevent at least a minimum amount of true R&D from taking place.

New raw materials of potential interest to the paint and coatings industry continue to be unveiled at the major coatings shows, although the flow of such new materials has definitely suffered during the past two years as a result of the urgent need for “all hands on deck” to deal with raw material substitutions (for customers and their own products), as well as shortages and late deliveries. There is no need to be concerned that there aren’t any new raw materials around, however. Demand for new specialty chemicals will arise from the increasing move of the specialty chemical industries to embrace ESG (Environmental, Social, and Governance) as a part of strategic planning, the increasing interest of both businesses and the public in the environment, and the high-level interest in antimicrobial paints and coatings.

At a time when “sustainability” (once largely seen as a form of “green washing”) is attracting more serious attention than ever before, we should expect to see a significantly greater emphasis placed on sustainability in formulation, production, packaging, and application as we move out of the current situation and can begin to concentrate on the way forward from here. These issues will guarantee a steady flow of new raw materials for all businesses that either make or use specialty chemicals.4,5

Where to from Here?

In order to be successful, raw material suppliers will need to support the changing performance requirements of their paint and coatings customers’ needs. Increasing consumer interest in product safety (health and environmental) is leading to more stringent requirements for low/no odor and low/no VOC content. Similarly, demand for environmentally safe paints and coatings from architects and construction firms is picking up as a result of regulatory, NGO, and consumer interest. Finally, the vox populi is becoming increasingly vocal about the raw materials used to make paints and coatings (e.g., PFAS—per- and polyfluoroalkyl substances), and this is only going to become more prevalent, not less.

The value of the global paint and coatings industry, lost during the ravages of COVID in 2020, was recovered by the end of 2021. However, this was due to the significant price increases initiated by the raw material suppliers and the coatings products—volume was essentially flat (Figure 4).

The greatest toll taken on the industry during 2020-2022 was one that is not easily measured but is nevertheless very real and very damaging: the loss of knowledge. Experience must be developed over time, often over decades—it cannot be created or duplicated in the short term. The loss of key personnel (especially in the technology and supply chain functions) who were terminated in a short-sighted effort to save money, burned out and left the industry, or who simply could not stand the stress and retired much earlier than they had planned, will be felt by the paint and coatings industry for many years to come.

While this loss of experience (the “brain drain”) was certainly having an effect in 2019, it was dramatically accelerated from 2020-2022 and has continued into the first half of 2023. At ChemQuest, we are already seeing the effects of the loss of experience in the coatings industry, both pre-COVID and especially post-supply chain disaster. Raw material suppliers and paint producers alike are looking to universities, independent third-party technology institutions, and third-party testing laboratories to supply them with the experience that was once “in house” but has now disappeared and cannot be backfilled with other personnel who lack extensive experience. This knowledge vacuum has given the coatings industry a golden opportunity for exploring the experience and creativity of highly experienced, independent paint and coatings experts and institutions that bring a wealth of technical knowledge and operational know-how to bear upon the challenges and opportunities of the paint and coatings producers who seek their help to solve a universe of diverse issues in an efficient, cost-effective manner.

Historically, the paint and coatings industry in the United States has been very nearly synonymous with “NIH” Syndrome (“Not Invented Here”), but the many environmental, regulatory, and consumer perception challenges that are facing us with ever-increasing frequency and intensity will make this mindset impractical in the future. The challenges facing the paint and coatings industry are going to be increasingly challenging and complex; simply think of how users of fluorine-containing polymers and additives are going to replace PFAS to gain some idea of what lies ahead…and it will not stop with PFAS.

The good news is that the COVID-induced supply chain crisis is 90% behind us and continues to wind down. The challenging news is that future paint and coatings developments are going to be more driven than ever by regulatory agencies, environmentalists, NGOs, and consumers. Very few, if any, paint and coatings producers are prepared to embark on the types of R&D programs that are going to be required to deal with the future demands that will be placed upon them. The “way forward” is going to be “out with NIH” and in with experience and expertise that can only be provided by third-party advisors with extensive and varied backgrounds, different viewpoints, and new ideas.

For more information, contact the author at gpilcher@chemquest.com or visit https://chemquest.com.

References

1. Pilcher, G.R. The Global Supply Chain Fiasco of 2021-2022: The Immediate Danger is Past, but What Lies Ahead? CoatingsTech, 2023, 20(3), 32.

2. Felsenthal, E. WEF’s Klaus Schwab on What’s Ahead. Time, 2023, Vol. 201(3-4), 60-61.

3. Pilcher, G.R. loc. cit.

4. Pilcher, G.R. Raw Materials 2022: On-going Difficulties but Faint Light—and Exciting New Raw Materials—At the End of the Tunnel. CoatingsTech, 2022, 19 (4), 23.

5. Pilcher, G.R. Global Supply, op. cit., 36.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!