The Protective Nanocoatings Market: Tiny Technology, Massive Growth

By 2025, it is estimated that the global market value for nanocoatings will climb to $17.2 billion, an all-time high. This market is all-encompassing, offering diverse applications, including anti-fouling, fingerprint resistance, water repellency for clothing, and even bacteria growth prevention to curb infectious spread.

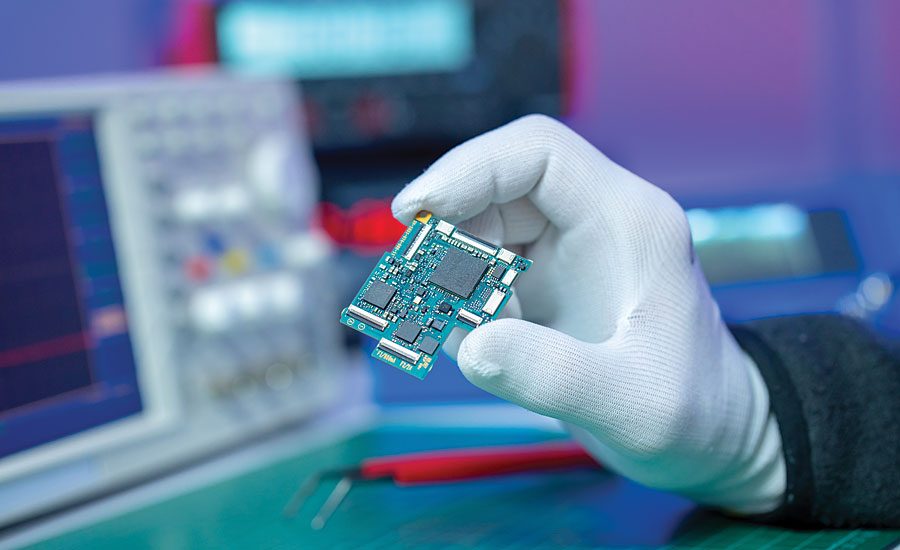

But the growth of protective coatings for electronics is unparalleled, as billions of electronic devices (41.6B by 2025, to be specific) deploy into diverse and challenging environments. These devices require protection against threats, including rain, sweat, submersion, pollution and more. As traditional protection methods can fall short for these new, miniaturized, edge electronics, protective nanocoatings offer promising safeguarding solutions and massive growth potential.

Protective Nanocoatings for Electronics

Years ago, desktop computers were safely perched in offices. Today, smaller devices must operate with resilience, independent of environments. For connected components, familiar elements have become failure-inducing variables. Humidity, corrosives, contaminants, liquids, temperature extremes, and electrical activity can all wreak havoc.

Sensitive circuitry requires protection. For years, the paint and coatings industry has used conventional means to meet this need. Barrier, inhibitive, sacrificial and combination coatings, including polymeric materials such as acrylics, urethanes, silicones and epoxies, protect metals and surfaces. Unfortunately, these coatings can be too thick, too porous and too bulky for miniaturized devices. Meanwhile, an increasing emphasis on sustainability is brewing in the industry. Increasing regulations, such as REACH, RoHS, PFOA/PFOS-free and CA Prop 65 compliance, raise the bar for selecting materials. Non-biodegradable, toxic chemicals will soon no longer be workable options for component protection. Foreseeing these roadblocks, manufacturers are shifting strategies, breaking with traditional coatings. Protective nanocoatings, thinner than a piece of paper, offer a robust alternative.

Why Are Protective Nanocoatings a Better Solution?

Like traditional coatings, nanocoatings and thin-film alternatives are deposited on a surface to improve protection. The difference is that a protective nanocoating can be as thin as a few nanometers, typically starting at 300 nm. This profile minimizes unit weight and mass, which proves useful for compact devices. Though super thin, their protection from ice, wear, pollutants, heat and corrosion surpass traditional coatings. Alternative benefits can include suitable dielectric and thermal management properties and hydrophobic and oleophobic characteristics. The protection can be tailored to circumstances by selecting and combining various materials. Nanocoatings and thin films are functionalized to solve specific business challenges; an efficient, competitive solution.

Increasing global regulations aren’t typically an issue with nanocoatings, as most are REACH and RoHS compliant with minimal to no VOC content. Many protective nanocoating vendors practice proactive chemical management, material oversight and corporate sustainability. These focuses, coupled with green material usage and preparation for repair and recycling, make for a sustainable solution.

Market Growth Rate and Key Growth Drivers

Analysts expect the global nanocoatings market to grow at a CAGR of 17.22% from 2018 to 2025. Growth drivers include the ability to engineer films for:

- Liquid splash and immersion protection

- Corrosion resistance

- UV resistance

- Solvent and chemical protection

- Transparency

- Durability

- Advanced bonding between surface and coating

- Capacity to increase the lifespan and durability of the substrate

- Flame resistance and fuel and gas barriers

- Reduced manufacturing costs

- Replacement of toxic inhibitors with minimal VOC emissions

Protective Nanocoatings Applications

Consumer Electronics

The consumer electronics market size valued at USD 1 trillion in 2019 is estimated to grow at a CAGR of over 7% between 2020 and 2026. Cell phone damage alone due to liquid exposure is estimated to cost the industry upwards of $97.1B annually. Meanwhile, 90.5 million eReader owners want to view eBooks on the beach, at the pool or with a cup of coffee. Tired of repairs and replacements, waterproofing is table stakes for success with consumers. Waterproofing is only one need for consumer devices. Hearables and wearables, like smartwatches and earbuds, experience adverse operating conditions. Sweat, steam, perfume and cleaning fluids are but a few of the common hazards that jeopardize circuitry.

Smart home security products (cameras, video doorbells, alarms and smart locks), predicted to become a $4.3 billion industry by 2023, is another product line in need of protection. Pollution, moisture, corrosives and chemicals can cause unexpected or immediate failure.

Protective nanocoatings can exceed the industry standards for protection, including the IPC IP ratings, at an economical price. This solution is a competitive candidate for consumer electronics protection.

Medical Devices

The medical device industry is exponentially expanding, with growth fostered by an aging population and a desire to manage health proactively. By 2025, the medical device industry will be valued at $612.7 billion worldwide. Currently, one in 11 adults around the globe lives with diabetes. While glucose meters and insulin pumps are helpful devices, they are still vulnerable to splashes and spills. Diagnostic imaging also comprises an impressive market, valued at $40 billion. EEG analyzers face cleaning fluids, body fluids and other liquids daily, requiring protection. Finally, over 900 million people will experience hearing loss by 2050. This population will subject their hearing aids to sweat, moisture, humidity and body oils. Yet, hearing aid components can be as small as a pencil eraser. The healthcare community is actively exploring the robust, low-mass protection of nanocoatings.

Industrial

In the next four years, the global market size for the Industrial Internet of Things (IIoT) will reach $110.6 billion. This market growth necessitates protection from common industrial failure conditions. These environments include corrosives, contaminants, inclement weather, sulfuric gases and petroleum products. In the distributed energy generation (DEG) global market, expected to reach $573.7 billion by 2025, similar concerns exist. Digital logic controllers and other DEG products need to be resilient to avoid downtime and failure rates.

Meanwhile, the IoT market in oil and gas will hit $39.40 billion globally by 2023. To implement connected OT edge in these environments, manufacturers must put reliability first. Protective nanocoatings and thin-film solutions, with excellent corrosion-resistance properties and beneficial thermal and electrical properties, compare well to existing solutions that use operator-dependent processes that are not as repeatable.

Automotive

The automotive industry is making a paradigm shift towards autonomous products and technologies. By 2030, electronics will account for 50% of a car’s total cost worldwide, creating profitable opportunities. Global revenue for the connected car market will reach $166 billion by 2025. Autonomous vehicles (AV) are at the forefront of change, expected to comprise a quarter of the marketplace by 2040. AVs mandate unprecedented reliability; occupant safety is a paramount concern. Achieving this type of resiliency may seem impossible, given the harsh service environment. Oil, gas, antifreeze, corrosives, temperature extremes, contaminants, pollutants and humidity are all obstacles. Another concern is for automotive “lightweighting,” removing as much mass as possible. Finally, sustainability is growing in importance for the automotive industry. The need for low-weight, low-bulk, sustainable reliability makes protective nanocoatings a promising option.

IoT

Forecasts suggest that by 2030, around 50 billion IoT devices will be in use around the world, creating a massive web of interconnected devices spanning everything from smartphones to kitchen appliances. There will be 53.63 million active smart city connections in the European Union alone in the next couple of years. Cameras monitor traffic, while noise sensors alert personnel to the potential of danger. Smart cities must run dependably with cost contained and constituents safe. That means every component in the network must reliably run too. Everything from utility meters and cell phone towers is mission-critical, but salt fog, humidity, snow and dust storms are genuine threats to these IoT components. Sensors, switches and hubs are also devices that need thin, lightweight protection. Scalability, sustainability and minimal bulk are enticing benefits for protective nanocoatings in the IoT arena.

The Future of Protective Nanocoatings

The protective nanocoatings industry is well-established, but some measures need to be taken to adopt the new technology further to encourage its capable growth. More time and financial investment are required. Technological research is necessary. And it must fall in line with governments, research councils and regional development agencies. Further development of expertise must occur, and stakeholders must identify gaps in value chains. Stakeholders must use networking opportunities and open access facilities to develop new technology.

Most importantly, future products need to be produced responsibly. Public perception and risks must be addressed as products and processes mature. Any potential for the environment, health, life cycle analysis and safety risks must be minimized if protective nanocoatings are to be an acceptable mainstream solution.

The Big Picture

Independent of industry, the protective nanocoatings marketplace growth potential is considerable, as protecting electronics becomes increasingly challenging as devices shrink. Beyond protection, weight and mass, dielectric and thermal management also need to be considered in a protective solution and based on advancing regulations, environmentally sound solutions such as nanocoatings are gaining popularity. Ultimately, delivering resilience and durability helps minimize costs associated with repairs, warranty claims and service calls. Reliability mitigates liability, improving uptime, and drives incremental product value.

As the market continues to evolve, the future for protective nanocoatings looks bright. Thin-films and nanocoatings’ custom protection is an enticing solution over traditional protection across industries and offerings, ensuring that market value and interest in the technology will continue to trend upwards.

For more information, visit HZO Inc.'s website here.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!