COVID-19 Impacts May Echo Beyond 2020

HOUSTON — While chemical companies have been helping government and health authorities fight the COVID-19 pandemic by providing a strong supply of critical care supplies, demand and prices for critical materials, such as polyethylene and polypropylene, have slumped as automotive, construction, and consumer markets have weakened, according to a report released by Deloitte.

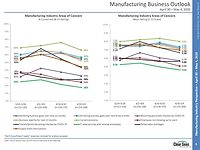

In a new report, Deloitte’s Midyear 2020 Chemical Industry Outlook, predicts U.S. chemical industry revenues may decline as much as 14-15% year-over-year in 2020.

To successfully navigate the challenging landscape, Deloitte outlines key considerations for chemical companies competing in the COVID-19 era. These considerations include the following.

Focusing on End-User Applications

While automotive, construction and consumer industries will likely trend downward in the near term, chemical companies could consider aligning their product strategy with market shifts and focus on new sources of demand, such as pharmaceuticals, nutrition and hygiene.

Adding Agility and Flexibility to Supply Chains

The pandemic highlighted challenges with globalized supply chains. And with emerging protectionist policies driving companies to bring home some of their supply chains, chemicals manufacturers may have to build resilience and robustness through inventory management and creating safety stock to mitigate risk.

Accelerating Digital Capabilities

Chemicals companies could chart a path to recovery by fast tracking the adoption of digital capabilities to increase efficiency. Digitalizing process and operations may help improve safety, cost-efficiency, and sustainability as well as modernize back-office activities, which in turn can enhance the customer experience.

Driving Value Through Smart M&A

While M&A volume may decline in the next quarter or two, companies with robust balance sheets could start to divest non-core and underperforming assets and consider M&A to drive value, which may lead to a rebound in deal activity by the end of 2020.

Learn more here.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!