New Monomer Technology

From Inception to Commercialization

I recently had the opportunity to visit Sirrus Inc., a chemical start-up based in Loveland, Ohio. The company was founded as Bioformix in 2009, and was purchased by Nippon Shokubai two years ago. Sirrus has developed cost-advantaged processes to produce reactive monomers at high purities. The company’s patented technology focuses on methylene malonate monomers and oligomeric crosslinkers that can polymerize anionically at ambient temperatures, reducing the cost and environmental footprint of many existing application processes. Because of their versatility, methylene malonate monomers have shown potential in a wide variety of applications, such as one- and two-component clear coatings for automotive and industrial use, adhesives for packaging and industrial use, waterborne coatings and adhesives, pressure-sensitive adhesives, encapsulated pigments, and composite binders.

The Sirrus chemistry is new, however, there has been longstanding interest in the monomer platform – beginning with the Perkin route back in 1886 with yields in the 10-20% range, followed by Eastman Kodak in 1940, and the Diels Alder route invented by Laboratories UPSA in 1960. As the process technology evolved, the yield increased and the cost for manufacturing decreased, however there were still several key challenges. In 2011, Sirrus developed its oligomer route, which overcame several challenges, including the batch process, space yield, purity levels and co-products. The company then developed its diol route in 2013, further increasing yield, scalability robustness and process conditions, and currently sees yields in the 90%+ range. Today, Sirrus is evaluating bio-based feedstock, which takes advantage of the oxygen density of the monomer platform.

Now, after 10 years of research, development and testing with partners, the company is nearly ready to commercialize its technology. Sirrus plans to bring its technology to market in 2020 with the opening of its first commercial-scale plant in Chattanooga, TN.

Company Development and Growth Strategy

The company’s CEO, Jeff Uhrig, has been with Sirrus for almost six years. With a chemical engineering background and a passion for the environment, Uhrig has spent the last 12 years working in environmental development roles. He has a Utopian vision of an advanced society with clean technology. During my visit, he told me about the company’s “inception to commercialization cycle”, its primary goals and long-term development strategy.

PCI: How is your chemistry different from existing technology available on the market?

Uhrig: Our core business platform is to produce methyl-ene malonates. We have done the hard work of converting a highly reactive material into something equally reactive but also with great performance properties. We expanded vertically into the supply chain and determined that in order to be successful we had to take the next step, which is developing malonate-derived molecules, and these took the form of monomers and oligomers – all reactive in nature.

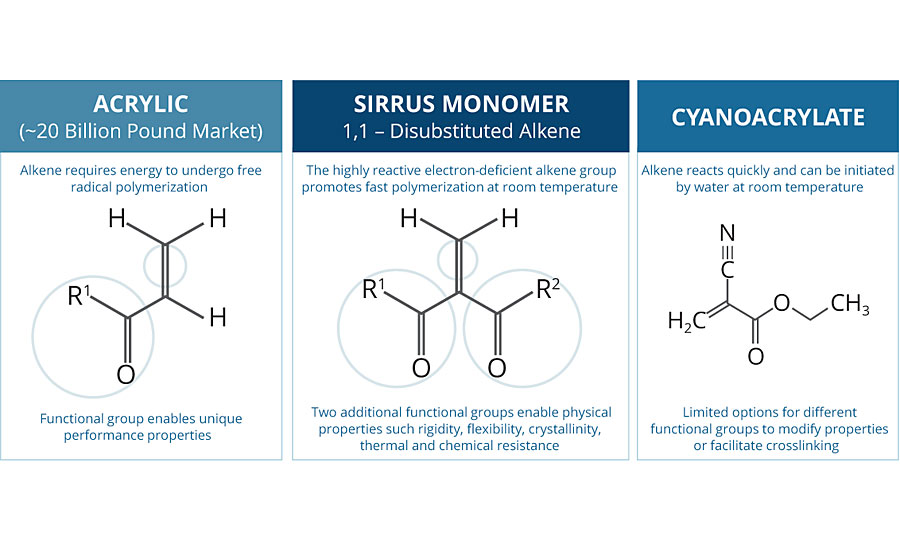

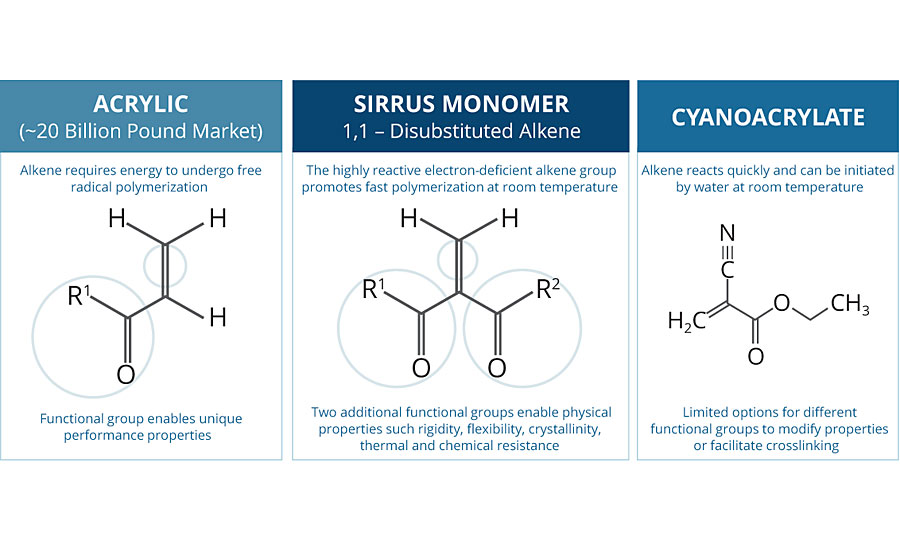

Methylene malonate monomer technology offers a unique set of attributes that together can impart physical property advantages to coating and adhesive formulations (Figure 1). These attributes include controlled, living anionic polymerization in commercially viable processes, enabling the production of polymers with narrow, controlled molecular weight distributions as well as block and hyperbranched structures; a broad range of functionality; UV, heat and oxidation stability; and low monomer viscosity, resulting in reduced solvent requirements in formulated products.

We have synthesized nearly 50 products with this new technology through a non-competitive, enzyme-catalyzed process, which resulted in molecules with a variety of performance benefits, but didn’t achieve the cost parameters that we required. We have since come up with technologies to make these lower cost. In that process we down-selected from the 50 materials into three (under the brand names Chemilian™ and Forza™), which when co-polymerized provide a breadth of properties but are also cost economical. We are leaving it up to the formulators to develop the applications they are used in, based on their needs and customer requests. We also know that some companies want niche materials, and we are willing to work with them on research contracts to develop unique products.

PCI: Is 10 years a typical time frame to develop a new technology such as this?

Uhrig: We have done a historical survey of new monomer platforms, and almost most without fail you see a 10-year “inception to commercialization” cycle. The cycle follows a similar trend. The first few years are spent trying to determine if the technology is real. Does it work and do we see something that is unique and interesting? This was the phase we were in from 2009-2013. We then had a breakthrough moment where we realized that, yes, this is real, and we need to fund it. We needed to develop a strategy and a business model around the platform. For us that meant a massive increase in overall yield for our product. Initial yield in 2009 was around 30%. By 2013 we had grown yields to over 60-65%. With that came the opportunity to have higher-purity products as well – higher performance at a lower cost. That allowed us to transition into a partnership model where we felt comfortable sending samples to people that could experiment with them, test them and determine if there was unique value in the market. Also in 2013 we began a very aggressive patent filing strategy. In November 2013, we had zero issued patents. Today we have 74 issued patents and 30 more pending. So 10 years later, we are still “pre-revenue”, but we are at the cusp of commercialization. To this end, we are in the final phase of design engineering for our first commercial facility.

PCI: What are the company’s primary goals?

Uhrig: Everyone on the leadership team is working toward three goals.

1. Sales and marketing. Developing a market penetration strategy to understand where our value proposition lies versus our competition. We generally view our competition to be acrylics, epoxies and isocyanates, or some combination thereof. So understanding where our materials can provide value and a competitive advantage is of utmost importance.

2. Product quality and product performance, which translates to pricing. How do we price these materials in a market that has been pretty heavily commoditized? Can we deliver something that is unique and then understand what that value proposition solves? For example, if our product helps reduce solvent use, how do we price our materials to then take advantage of that credit?

3. Reducing operating costs. Expanding margins in relation to processing yields, capital cost reductions and elimination of waste.

PCI: What is your long-term growth strategy?

Uhrig: We have a three-phase long-term growth philosophy.

1. Developing bio-based feedstock. Our molecule has incredible oxygen density, so from sucrose or glucose, which is 50% oxygen by mass, we have this incredible opportunity to source bio-based materials at low cost. We are evaluating several companies right now that are pursuing bio-based routes to our feedstock.

2. Conversion. Economically converting our material into something that we can sell. We are able to do this efficiently because our process requires no solvent, has no waste and uses no endangered rare earth catalysts. We have operating conditions generally under vacuum and at a maximum of about 250 °C. Our process is also water light. Combined, we believe these relatively benign operating conditions translate to low cost from the standpoint of operating and capital.

3. Focusing on customer needs. We feel like we fit into many global themes. Many of the things that our customers want, we are able to provide, whether it’s waterborne, low solvent, low-temperature curing, reduction of additives, etc. We also see permutational opportunities. Similar to acrylates, we believe we can functionalize our materials with a broad range of commercially available materials that may impart additional performance properties customers desire. We can reduce solvent, lower cure temperature and reduce additives, but we don’t have to get away from the existing techniques – this has been a breakthrough that we have seen recently.

Laboratories

I also met with Mark Holzer, Vice President, Application Development, and Andy Palsule, Director of Material Science, who took me on a tour of the company’s various labs.

In the Synthesis Lab, a team of six Ph.D. scientists work on fundamental synthetic schemes. They focus on new molecule development, which are synthesized and developed on a small sale to send to customers and to the company’s analytical and application labs. A second focus of this team is cost optimization, where they experiment with different catalysts and other products to try to reduce production costs.

The Analytical Lab performs several characterization and quality tests. The Sirrus products are very reactive, and a lot of attention is paid toward stabilization. This lab also uses a variety of analytical equipment to determine the products’ impurity profile. Other things tested are the acid content, compositional analysis and interaction analysis. Keep in mind that all of these molecules are new, and analytical methods have been developed from scratch; there is no reference point to work with previous materials.

The Applications Lab works with companies to develop coatings with specific properties to see where they can utilize the molecule and bring value. This is where the proof of concept happens. Things like speed of cure, low-energy cure and adhesion are evaluated and compared with existing coatings being used. So far, many benefits have been discovered. Due to the low-energy cure, there is huge application potential in helping automotive OEMs lightweight their vehicles. Parts that couldn’t be used in the past due to the high heat requirements for curing can now be used. Finish-in-place wood coatings can cure rapidly at 10 °C or lower with these molecules. They also contain ~5% solvent, compared to existing wood stains that have a much higher solvent content. And infrastructure coatings may be cured very quickly, shortening the return-to-service time. Waterborne emulsions can also be formed under ambient processing conditions in a few minutes. This eliminates the need for the traditional heating and cooling process previously required to polymerize latexes.

The Process Lab recently underwent a $2 million expansion to increase production. The expanded bench facility represents an important step in the design and construction of Sirrus’ full-scale production facility. “The expanded facility makes use of equipment that is scalable. This affords our engineering partners access to continuous process data, testing of control strategies and demonstration of in-process stabilization. This combination provides extreme confidence in producing these monomers in commercial quantities at our desired product specifications,” said Uhrig.

The pilot facility also gives Sirrus and its development partners access to larger quantities of the company’s materials. This will allow partners to conduct line trials and customer qualification, an important step towards advancing commercial off-take discussions. When operating continuously, the expanded facility will be able to produce up to two tonnes per month of monomer.

How This Technology is Different

While in the lab, Mark Holzer explained more about the company’s technology and how it is different from products that are currently available.

“Our methylene malonate monomers are highly electron deficient, which enables a unique anionic polymerization mechanism that takes place at ambient temperature while offering several things, including the ability to tune molecular weight by adjusting initiator concentration; basic substrate or surface initiation; a stable polyolefin backbone; the ability to use a broad range of benign initiators as a primer or to promote emulsion or solvent polymerization; living polymerization; the ability to sequentially add monomers to form random and block copolymers; and crosslinking of 2K systems.”

As polymer building blocks, methylene malonate monomers can yield entirely new polymer architectures, for coating and adhesives that offer a better balance of key physical and mechanical properties (Figure 2). Or the malonates can be incorporated into coatings and adhesives similar to the ones already in use, which may enhance curing and/or product performance.

“Our technology can also help meet sustainability goals. Malonate-based adhesives and coatings can polymerize anionically at ambient temperatures – and do so without slowing manufacturing lines. There’s a possibility to reduce or eliminate the need for UV light, high loadings of solvents, external heat sources or any other curing aid that increases energy usage or reduces operational sustainability,” Holzer added.

Methylene malonate-based coatings and adhesives can help take cost out of manufacturing processes as well by reducing energy and capital.

I would like to thank the entire Sirrus team for taking the time to educate me on their new technology. I look forward to attending the opening ceremony of their new facility in Tennessee in the near future!

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!