Economic Growth and Consumer Trends Key to Hot Melt Adhesives Market Growth

LEATHERHEAD, UK – Changing consumer trends taking hold at different rates globally will make hot melt adhesives a dynamic market that will grow to more than $7.5 billion by 2021, according to a new report from Smithers Apex.

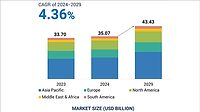

Smithers Apex’s analysis of the key drivers shaping this segment, The Future of Hot-Melt Adhesives to 2021, shows the global market for hot melt adhesives is estimated to be worth $5.45 billion as of 2015 and is expected to reach $7.57 billion by 2021 at an overall CAGR of 5.6 percent.

Hot melt adhesives are 100-percent solid thermoplastics that are applied molten at high temperature and will adhere to a surface when cooled to a temperature below its melting point. The fast setting time, which allows for the immediate use of the bonded product, makes hot melt adhesives a perfect choice in a number of consumer goods that are produced or assembled on high-speed production lines. These end-use segments include packaging, personal hygiene products, construction, bookbinding, labeling, tapes and automotive.

“Many of these consumer goods products are driven by economic growth and personal income, population growth and birth rates, as well as lifestyle choices and consumer trends,” said Line Willis, author of the report. “As a result, the hot melt adhesives demand and market opportunities are very different between the geographical regions and even between individual countries.”

The global hot melt adhesive market is a mixture of mature regions with modest growth rates and high market penetration, and fast-growing regions with a rapid increase in hot melt adhesives demand due to economic growth, increased personal wealth, and demographic changes.

Historically, the largest geographical market for hot melt adhesives has been North America, closely followed by Western Europe. This picture has changed in the last decade, with the rapid economic growth and industrial expansion in China. As a result, Asia-Pacific is now the largest geographical region for hot melt adhesives, estimated to be worth $2.9 billion in 2015 and forecast to reach $3.71 billion in 2021.

Another trend linked to cost cutting that affects the hot melt demand is reduction in consumption, or the coat weight of adhesives applied to each individual article. Equipment suppliers of adhesive dispensing systems have in recent years introduced several tools to significantly lower the coat weight of hot melt adhesives applied to each item, in order to reduce adhesive consumption. This trend is witnessed in all major hot melt applications, including packaging, labeling and personal hygiene products.

The largest market by end-use applications is packaging, which continues to grow due to lifestyle and demographic changes. Smaller single packs in consumer food are on the rise due to changes in family structures, with less of the traditional nuclear family and increasing single-person households. The smaller single pack is also driven by lifestyle changes and the desire for convenience, with the trend of consuming drinks and food “on the go.” The consumer food segment within packaging is less vulnerable to economic downturns in comparison to most other consumer goods products.

The hot melt adhesive market for the packaging sector in estimated to be worth $1.69 billion in 2015 and forecast to be worth $2.34 billion by 2021.

Other areas that will be significant for the hot melt adhesives market to 2021 include personal hygiene products, also referred to as nonwovens. While market penetration in advanced economies is very high for disposable hygiene products, less advanced economies, including emerging market, have in many cases as low as 15 percent market penetration in diapers – presenting a growth opportunity that will in turn impact the use of hot melt adhesives.

Click here for more information about the report.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!