Global TiO2 Magnates’ Collective Price Hikes to Revive China’s TiO2 Industry

On Dec 17., 2015, successive global TiO2 magnates raised their product prices in just five days and the average increase in prices was about USD150/t. TiO2 magnates had high stock levels since the beginning of the second quarter of 2015, which has put them under pressure. In order to relieve this situation, they sacrificed profits to reduce inventory level, and the price of TiO2 continued to drop.

TiO2 magnates were always cautious about raising TiO2 prices, especially when it came to raise price in the Asia-Pacific region. The Chemours Company (Chemours) published some announcements about raising prices, but none of the announcements had mentioned raising price in the Asia-Pacific region.

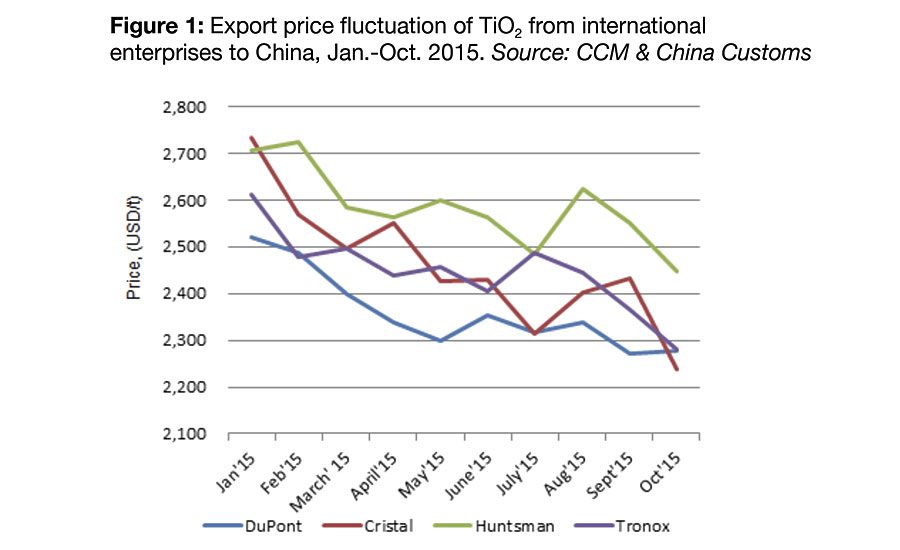

According to data from the General Administration of Customs of the P.R.C. (China Customs), the average export price of TiO2 from international enterprises (such as Chemours, Huntsman and Tronox) to China was about USD2,250/t, down by 10% compared with that in Jan. 2015.

It is well known that December is the off-season for the global TiO2 industry. Market demand from downstream markets is sluggish and it is supposed to be the most intensely competitive period for all TiO2 enterprises. However, four international TiO2 magnates raised their product prices. CCM believes it was mainly because:

1. The global price of TiO2 remained at a low stage since Jan. 2015, leading to reduction and suspension of production for most of the TiO2 magnates. During a single month, from 27 July to 26 Aug., three international TiO2 enterprises (Chemours, Huntsman and Tronox) partially shut down their TiO2 production lines. Output reduction and frequent markdown promotions greatly reduced companies' profits while relieving stock pressure, which provided the confidence required for international magnates to raise prices.

2. The collective TiO2 price rises were just before the New Year. Raising product prices before the year end can help raise company shares in the short term.

It is worth mentioning that with the influence of the collective price rises, the concept stock of TiO2 rose across the board in China. Stock prices of many companies such as CNNC Hua Yuan Titanium Dioxide Co., Ltd., Henan Billions Chemicals Co., Ltd., Jilin GPRO Titanium Industry Co., Ltd. and Anhui Annada Titanium Industry Co., Ltd. realized limit-up on 22 Dec. and became the hottest aspects of the Chinese security market that day.

CCM leaned from insiders of domestic TiO2 enterprise that the TiO2 price in China's market will stop falling shortly after the collective price rises of global TiO2 magnates. The future trends may be:

- China's TiO2 enterprises may follow global TiO2 magnates’ lead and raise prices, and those enterprises' profitability would be enhanced in this situation.

- Or, China's TiO2 enterprises may continue to keep prices low in order to quicken their acquisition of TiO2 market share.

No matter which will come to pass, there is one thing that we can be sure of: global TiO2 magnates' collective price rises are good news for China's TiO2 enterprises suffering from the downturn.

CCM believes that it is very likely that the market price of TiO2 may increase slightly in the short term. Small- and medium-sized TiO2 enterprises that haven't made profits for a long time may follow the lead of global TiO2 magnates and raise prices to get themselves out of the predicament they were in, being that sales prices were lower than the cost of production.

However, leading enterprises like Sichuan Lomon Titanium Co., Ltd., may raise their product quotations while retaining low real transaction prices for the following two reasons:

1. December is always the off-season for TiO2 in China. As the domestic TiO2 industry suffers oversupply issues, downstream industries like the coating and plastics industries always have more influence in market bargaining. Large enterprises have no need to take the risks of losing customers for short-term interests, and in the meantime, they can still make profits from the present low prices, so there is no urgent need for them to raise prices.

2. The collective price rises provides a wonderful chance for China's TiO2 enterprises who intend to extend their overseas market shares. They may be willing to exchange some of their profit for overseas market shares with high cost performances.

For more information, visit www.cnchemicals.com.

By CCM, Shanghai, China

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!