AkzoNobel Discusses Environment-Friendly Technologies and Sustainability

PCI recently spoke with Nigel Shewring, R&D Director for AkzoNobel’s Powder Coatings business, and Derek Rance, Director, RD&I Projects for AkzoNobel Performance Coatings, regarding trends in green technology and the issue of sustainability.

PCI: Powder coatings are an environment-friendly technology in terms of low-VOCs, however growth for this market is slower than other technologies. Why do many end users choose to stick with liquid coatings?

Shewring: Compared to liquid coatings, powder coatings have several advantages in terms of sustainability, and long-term can be the most effective and efficient solution. At AkzoNobel we typically model the energy and economics of various options for a customer (in some cases calculating the carbon footprint) to ensure we offer the best possible solution whether it be powder, liquid or a powder/liquid hybrid solution.

Although many customers continue to convert to powder from liquid, the initial change may not be simple, being driven by practicality, availability of new technology (e.g. appearance, application) and most importantly, economics. Paint shops represent a significant capital investment, which means they are usually only replaced after a minimum of 10 years. Clearly it is cheaper to invest in a refurbishment of a liquid paint line, for example from solventborne to waterborne, than to invest in a totally new powder coatings line. Allied to the economics is that the change from solvent to waterborne minimizes the need to learn new technologies and skills compared to the shift to powder.

Liquid coating systems often achieve their performance through the use of multiple, thin film layers. Powder’s inherent strength is in achieving high performance with a single layer, of a similar build to the multiple liquid coatings. However, this becomes a limitation when each of the liquid layers is achieving a specific purpose, for example anti-corrosive primer, metallic basecoat, high-flow clearcoat. This is where new technology such as Interpon D Brilliance (single-coat sparkle metallics for architectural) and Interpon Align (two coats of powder with one bake step) help the customer to more easily make the conversion, as well as offering significant economic benefits to existing powder customers.

The perceived high temperatures required to cure powders can also be seen as a barrier to convert. This is true for temperature-sensitive substrates, but for substrates that are not sensitive to higher temperatures, the energy cost is a smaller part of the total applied cost compared to common perception. If you add in costs such as pre-treatment, paint booth air management, forced-air drying booths for waterborne, and thermal abatement for the liquid booth exhaust, the economic balance is in favour of powder coatings.

For some customers, fast color change capability is seen as an obstacle; although powder booths can be cleaned quickly and safely with only compressed air. For a state-of-the-art liquid application facility (e.g., at an OEM) this can be achieved in less than one minute, and despite advances in new application technology the time required to completely clean a powder booth is substantially longer.

Finally, the size of the structure to be painted, or more specifically the oven required to house the structure, can represent a limitation. So while relatively large components such as an entire truck cab are being successfully powder coated, an ocean-going liner cannot.

At the same time, our liquid paint colleagues and the paint shop equipment manufacturers have not stood still in their development of low-VOC technologies. Ultimately, the customer chooses the best performance with the best value proposition that can be selected from multiple technologies.

PCI: What involvement does AkzoNobel have in the powder coatings arena? Do you see continued growth for this market?

Shewring: AkzoNobel is the largest global supplier of powder coatings. We continue to develop powder technologies and markets. For example, this year we launched Interpon Align. This technology allows the application of a two-coat powder coating, without having to cure the primer layer. The energy savings are obvious, but this technology also offers the opportunity to synchronize all the stages in the application process and remove bottlenecks. In one example the customer was able to achieve a 15% productivity increase with no additional capital or labour investment.

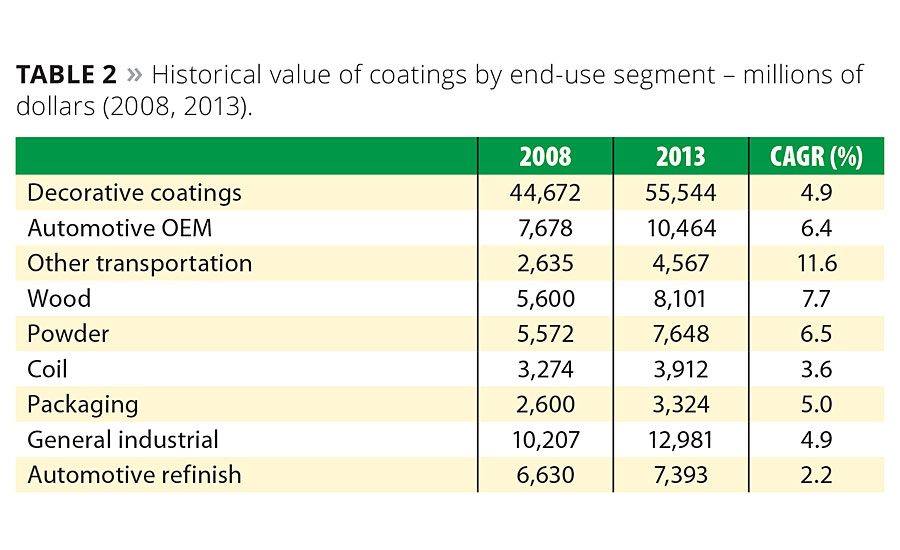

By volume and value, powder coatings’ growth over the recent years has been comparable if not faster than traditional performance coatings end-user markets (Tables 1 and 2), and we expect this trend to continue in the future. Another factor is that powder is becoming the preferred technological solution. For example, an acrylic powder clearcoat is the preferred technology in North America for machined aluminium alloy wheels. In these cases where we have a mature market technology, future growth is directly tied to the underlying market.

PCI: What are the benefits and drawbacks of biobased coatings technologies? Are customers willing to pay for this technology?

Rance: It is interesting to reflect that before the advent of synthetic polymers, thickeners and additives, coating technologies were entirely biobased, using for example alkyd, rosin or nitrocellulose vehicles. In a sense, we are now seeing a lot of interest in ‘re-greening’ coatings offerings in a number of markets. While previous biobased technologies were solvent based, the focus now is to incorporate biobased materials into waterborne or solventless radiation-cure technologies. The primary benefit is in the cost of biobased feedstocks, especially when derived from biomass, particularly wood and agricultural waste. However, the volatility in oil prices can undermine the attractiveness of biobased feedstocks from time to time. On the downside, biobased materials do not always provide the range of application and performance characteristics needed to meet customer specifications, whereas synthetic approaches provide better control of the desired performance profile. In the coatings industry, customers make product selection choices based on the balance of cost and performance. If a biobased solution delivers the same performance as a synthetic one, customers are not yet prepared to purchase a biobased material if it comes at a price premium.

PCI: Developing low- or zero-VOC coatings continues to be a main driver for coatings manufacturers. What challenges still exist in this field, and how are you overcoming them?

Rance: Reducing energy and waste across the value chain, together with limiting raw material usage in coating formulas will become increasingly important aspects of product formulation strategies as materials become scarcer. A key aspect of these strategies is the reduction of VOCs. Solvents play an important role in coatings formulations to enable substrate wetting, flow and leveling, film formation and the development of high-gloss surfaces or surfaces with controlled topology. Challenges still exist in all technologies used to reduce or eliminate VOCs, including high-solids solventborne, waterborne, radiation-cure and solid solutions such as powder, paint film or lamination.

With high-solids solventborne or VOC-free products used in protective or marine coatings, the challenge is in the application of the higher-viscosity materials whether by roller coat or spray. In many cases, a switch from conventional application equipment to plural gun application, hot application or other novel application techniques may be required to achieve the desired film build, flow and levelling.

For waterborne technologies, the decorative paint market in particular has made great strides in lowering and eliminating VOCs since the first products were introduced into the market about 20 years ago. Improvements continue to be made in flow and levelling, and hence the appearance of latex paints, particularly at the higher sheen levels. For painters who prefer the durability of alkyd paints, considerable progress has been made in the development of lower-VOC alkyd emulsions, which deliver the same performance as the solventborne equivalents but at considerably lower VOC.

In the wood finishes market, particularly the flat line OEM segment, solventborne basecoats and topcoats are being substituted by waterborne basecoats and 100%-solids or waterborne UV-cure topcoats. This transition is driven by the increased productivity that customers can achieve through the short cure cycle that can be obtained with UV technology. However, conversion to UV technology is slow as a result of the high capital cost involved for radiation curing.

The challenges associated with powder coatings have been mentioned earlier in this article, but it is interesting to see other 100%-solids solvent-free technologies continuing to make progress in the coatings market. AkzoNobel has introduced a number of solid paint film solutions in the automotive market. A scratch repair solution is provided by stickerfix™. This is an adhesive paint film kit distributed by automotive companies in colors matched to their OEM color palette. Paint film with the right dimensions can be selected from the repair kit and be positioned in place, with the repair completed in minutes. Fluorex Paintfilm®is the film alternative to traditional spray application systems where a full palette of colors is possible including metallic, pearlescent and even anodized finishes. The technology utilizes the same pigment types as solventborne spray-applied systems in combination with chemical and weather-resistant resins, and is applied to plastic components in automotive interior and exterior applications.

PCI: What is AkzoNobel doing to strive for sustainability and to educate the coatings industry on this important issue?

Shewring and Rance: Our view on sustainability and on the future is based on optimism. Indeed the world faces big challenges, and radical changes are needed, but the good news is that these changes are possible. As well as driving our own success, putting sustainability and innovation at the heart of everything we do means that our customers and employees – not to mention the planet – will also benefit.

Our biggest challenge is to stay on track to meet the tough targets that we have set for ourselves as part of our strategy. We aim for 20% of our revenue by 2020 to come from products that are more sustainable for our customers than those of our competitors. And we aim at 25-30% more efficient resource and energy use across the entire value chain by 2020. And finally, we have a new indicator (REI) measuring how efficiently we generate value expressed as gross margin divided by cradle-to-grave carbon footprint.

But we can’t achieve these targets on our own. Our strategy is about connecting people. Getting our employees engaged, but also working more closely than ever with our key stakeholders to positively impact the coatings industry. It’s all about making a difference across the entire value chain. We call this approach Planet Possible – our commitment to doing more with less

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!